Section A BOTH questions are compulsory and MUST be attempted

1 Nente Co, an unlisted company, designs and develops tools and parts for specialist machinery. The company was

formed four years ago by three friends, who own 20% of the equity capital in total, and a consortium of five business

angel organisations, who own the remaining 80%, in roughly equal proportions. Nente Co also has a large amount

of debt finance in the form of variable rate loans. Initially the amount of annual interest payable on these loans was

low and allowed Nente Co to invest internally generated funds to expand its business. Recently though, due to a rapid

increase in interest rates, there has been limited scope for future expansion and no new product development.

The Board of Directors, consisting of the three friends and a representative from each business angel organisation,

met recently to discuss how to secure the company’s future prospects. Two proposals were put forward, as follows:

Proposal 1

To accept a takeover offer from Mije Co, a listed company, which develops and manufactures specialist machinery

tools and parts. The takeover offer is for $295 cash per share or a share-for-share exchange where two Mije Co shares

would be offered for three Nente Co shares. Mije Co would need to get the final approval from its shareholders if either

offer is accepted;

Proposal 2

To pursue an opportunity to develop a small prototype product that just breaks even financially, but gives the company

exclusive rights to produce a follow-on product within two years.

The meeting concluded without agreement on which proposal to pursue.

After the meeting, Mije Co was consulted about the exclusive rights. Mije Co’s directors indicated that they had not

considered the rights in their computations and were willing to continue with the takeover offer on the same terms

without them.

Currently, Mije Co has 10 million shares in issue and these are trading for $480 each. Mije Co’s price to earnings

(P/E) ratio is 15. It has sufficient cash to pay for Nente Co’s equity and a substantial proportion of its debt, and

believes that this will enable Nente Co to operate on a P/E level of 15 as well. In addition to this, Mije Co believes

that it can find cost-based synergies of $150,000 after tax per year for the foreseeable future. Mije Co’s current profit

after tax is $3,200,000.

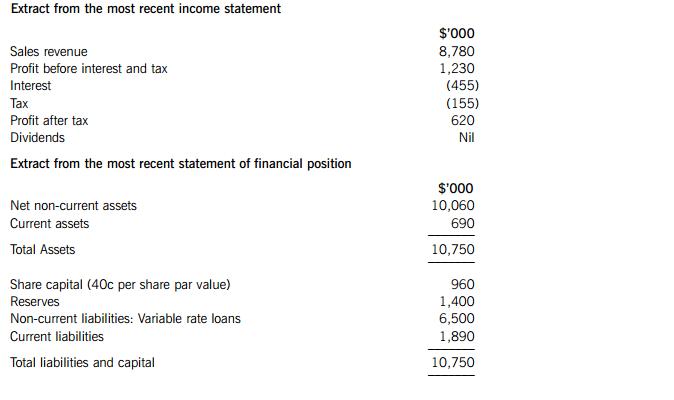

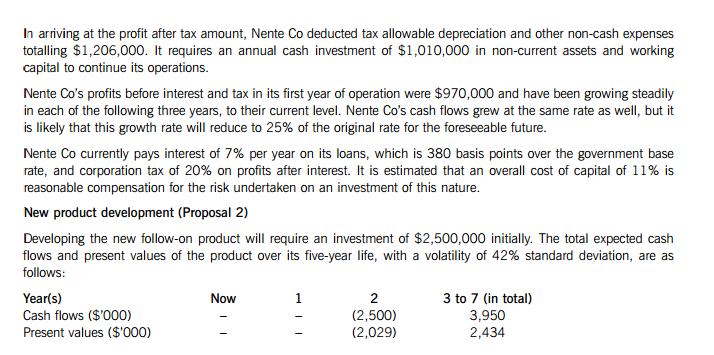

The following financial information relates to Nente Co and to the development of the new product.

Nente Co financial information

Required:

Prepare a report for the Board of Directors of Nente Co that:

(i) Estimates the current value of a Nente Co share, using the free cash flow to firm methodology; (7 marks)

(ii) Estimates the percentage gain in value to a Nente Co share and a Mije Co share under each payment offer;

(8 marks)

(iii) Estimates the percentage gain in the value of the follow-on product to a Nente Co share, based on its cash

flows and on the assumption that the production can be delayed following acquisition of the exclusive rights

of production; (8 marks)

(iv) Discusses the likely reaction of Nente Co and Mije Co shareholders to the takeover offer, including the

assumptions made in the estimates above and how the follow-on product’s value can be utilised by

Nente Co. (8 marks)

Professional marks will be awarded in question 1 for the presentation, structure and clarity of the answer.

(4 marks)

(35 marks)

Ennea Co’s forecast after tax profit for the coming year is expected to be $26 million and its current share price is

$320 per share. The non-current liabilities consist solely of a 6% medium term loan redeemable within seven years.

The terms of the loan contract stipulates that an increase in borrowing will result in an increase in the coupon payable

of 25 basis points on the total amount borrowed, while a reduction in borrowing will lower the coupon payable by

15 basis points on the total amount borrowed.

Ennea Co’s effective tax rate is 20%. The company’s estimated after tax rate of return on investment is expected to

be 15% on any new investment. It is expected that any reduction in investment would suffer the same rate of return.

Required:

(a) Estimate and discuss the impact of each of the three proposals on the forecast statement of financial

position, the earnings and earnings per share, and gearing of Ennea Co. (20 marks)

(b) An alternative suggestion to proposal three was made where the non-current assets could be leased to other

companies instead of being sold. The lease receipts would then be converted into an asset through securitisation.

The proceeds from the sale of the securitised lease receipts asset would be used to reduce the outstanding loan

borrowings.

Required:

Explain what the securitisation process would involve and what would be the key barriers to Ennea Co

undertaking the process. (5 marks)

(25 marks)

4Section B TWO questions ONLY to be attempted

3 Sembilan Co, a listed company, recently issued debt finance to acquire assets in order to increase its activity levels.

This debt finance is in the form of a floating rate bond, with a face value of $320 million, redeemable in four years.

The bond interest, payable annually, is based on the spot yield curve plus 60 basis points. The next annual payment

is due at the end of year one.

Sembilan Co is concerned that the expected rise in interest rates over the coming few years would make it increasingly

difficult to pay the interest due. It is therefore proposing to either swap the floating rate interest payment to a fixed

rate payment, or to raise new equity capital and use that to pay off the floating rate bond. The new equity capital

would either be issued as rights to the existing shareholders or as shares to new shareholders.

Ratus Bank has offered Sembilan Co an interest rate swap, whereby Sembilan Co would pay Ratus Bank interest

based on an equivalent fixed annual rate of 376¼% in exchange for receiving a variable amount based on the current

yield curve rate. Payments and receipts will be made at the end of each year, for the next four years. Ratus Bank will

charge an annual fee of 20 basis points if the swap is agreed.

Required:

(a) Provide a reasoned estimate of the cost of capital that Tisa Co should use to calculate the net present value

of the two processes. Include all relevant calculations. (8 marks)

(b) Calculate the internal rate of return (IRR) and the modified internal rate of return (MIRR) for Process Omega.

Given that the IRR and MIRR of Process Zeta are 266% and 233% respectively, recommend which

process, if any, Tisa Co should proceed with and explain your recommendation. (8 marks)

(c) Elfu Co has estimated an annual standard deviation of $800,000 on one of its other projects, based on a normal

distribution of returns. The average annual return on this project is $2,200,000.

Required:

Estimate the project’s Value at Risk (VAR) at a 99% confidence level for one year and over the project’s life

of five years. Explain what is meant by the answers obtained. (4 marks)

(20 marks)

65 Kilenc Co, a large listed company based in the UK, produces pharmaceutical products which are exported around the

world. It is reviewing a proposal to set up a subsidiary company to manufacture a range of body and facial creams in

Lanosia. These products will be sold to local retailers and to retailers in nearby countries.

Lanosia has a small but growing manufacturing industry in pharmaceutical products, although it remains largely

reliant on imports. The Lanosian government has been keen to promote the pharmaceutical manufacturing industry

through purchasing local pharmaceutical products, providing government grants and reducing the industry’s corporate

tax rate. It also imposes large duties on imported pharmaceutical products which compete with the ones produced

locally.

Although politically stable, the recent worldwide financial crisis has had a significant negative impact on Lanosia. The

country’s national debt has grown substantially following a bailout of its banks and it has had to introduce economic

measures which are hampering the country’s ability to recover from a deep recession. Growth in real wages has been

negative over the past three years, the economy has shrunk in the past year and inflation has remained higher than

normal during this time.

On the other hand, corporate investment in capital assets, research and development, and education and training,

has grown recently and interest rates remain low. This has led some economists to suggest that the economy should

start to recover soon. Employment levels remain high in spite of low nominal wage growth.

Lanosian corporate governance regulations stipulate that at least 40% of equity share capital must be held by the

local population. In addition at least 50% of members on the Board of Directors, including the Chairman, must be

from Lanosia. Kilenc Co wants to finance the subsidiary company using a mixture of debt and equity. It wants to raise

additional equity and debt finance in Lanosia in order to minimise exchange rate exposure. The small size of the

subsidiary will have minimal impact on Kilenc Co’s capital structure. Kilenc Co intends to raise the 40% equity

through an initial public offering (IPO) in Lanosia and provide the remaining 60% of the equity funds from its own

cash funds.

Required:

(a) Discuss the key risks and issues that Kilenc Co should consider when setting up a subsidiary company in

Lanosia, and suggest how these may be mitigated. (15 marks)

(b) The directors of Kilenc Co have learnt that a sizeable number of equity trades in Lanosia are conducted using

dark pool trading systems.

Required:

Explain what dark pool trading systems are and how Kilenc Co’s proposed Initial Public Offering (IPO) may

be affected by these. (5 marks)

(20 marks)

It is unlikely that Nente Co shareholders would accept the cash offer because it is little more than the estimated price of a Nente

Co share before the takeover offer. However, the share-for-share offer gives a larger increase in value of a share of 179%. Given

that the normal premium on acquisitions ranges from 20% to 40%, this is closer to what Nente Co shareholders would find

acceptable. It is also greater than the additional value from the follow-on product. Therefore, based on the financial figures, Nente

Co’s shareholders would find the offer of a takeover on a share-for-share exchange basis the most attractive option. The other

options considered here yield lower expected percentage increase in share price.

Mije Co shareholders would prefer the cash offer so that they can maximise the price of their shares and also not dilute their

shareholding, but they would probably accept either option because the price of their shares increases. However, Mije Co

shareholders would probably assess whether or not to accept the acquisition proposal by comparing it with other opportunities that

the company has available to it and whether this is the best way to utilise its spare cash flows.

The calculations and analysis in each case is made on a number of assumptions. For example, in order to calculate the estimated

price of a Nente Co share, the free cash flow valuation model is used. For this, the growth rate, the cost of capital and effective

time period when the growth rate will occur (perpetuity in this instance) are all estimates or based on assumptions. For the takeover

offer, the synergy savings and P/E ratio value are both assumptions. For the value of the follow-on product and the related option,

the option variables are estimates and it is assumed that they would not change during the period before the decision. The value

of the option is based on the possibility that the option will only be exercised at the end of the two years, although it seems that

the decision can be made any time within the two years.

The follow-on product is initially treated separately from the takeover, but Nente Co may ask Mije Co to take the value of the

follow-on product into consideration in its offer. The value of the rights that allow Nente Co to delay making a decision are

themselves worth $603,592 (appendix iii) and add just over 25c or 87% to the value of a Nente Co share. If Mije Co can be

convinced to increase their offer to match this or the rights could be sold before the takeover, then the return for Nente Co’s

shareholders would be much higher at 266% (179% + 87%).

In conclusion, the most favourable outcome for Nente Co shareholders would be to accept the share-for-share offer, and try to

convince Mije Co to take the value of the follow-on product into consideration. Prior to accepting the offer Nente Co shareholders

would need to be assured of the accuracy of the results produced by the computations in the appendices.

Interest saved totals $1,432,000 ($1,296,000 + $136,000). The reduction in investment of $25 million will lose

$3,750,000, at a rate of return of 15%. Net impact is $2,318,000 loss which is subtracted from earnings as a reduction

from profit after tax and deducted from current assets as a cash expense (presumably). Overall therefore the profit is

reduced by $318,000 [$2,000,000 $2,318,000].

If the profit from the sale of the asset is assumed to be $1,600,000 ($2,000,000 less tax), then the statement of financial

position, EPS and gearing figures will all change to reflect this.

Discussion

Proposals 1 and 3 appear to produce opposite results to each other. Proposal 1 would lead to a small increase in the earnings

per share (EPS) due to a reduction in the number of shares although profits would decrease by approximately 5%, due to the

increase in the amount of interest payable as a result of increased borrowings. However, the level of gearing would increase

substantially (by about 30%).

With proposal 3, although the overall profits would fall, because of the lost earnings due to downsizing being larger than the

gain in interest saved and profit made on the sale of assets, this is less than proposal 1 (12%). Gearing would reduce

substantially (192%).

Proposal 2 would give a significant boost in the EPS from 2167c/share to 2310c/share, which the other two proposals do

not. This is mainly due to increase in earnings through extra investment. However, the amount of gearing would increase by

more than 13%.

Overall proposal 1 appears to be the least attractive option. The choice between proposals 2 and 3 would be between whether

the company would prefer larger EPS or less gearing. This would depend on factors such as the capital structure of the

competitors, the reaction of the equity market to the proposals, the implications of the change in the risk profile of the

company and the resultant impact on the cost of capital. Ennea Co should also bear in mind that the above are estimates

and the actual results will probably differ from the forecasts.

(Note: credit will be given for alternative relevant comments and suggestions)

(b) Asset securitisation in this case would involve taking the future incomes from the leases that Ennea Co makes and converting

them into assets. These assets are sold as bonds now and the future income from lease interest will be used to pay coupons

on the bonds. Effectively Ennea Co foregoes the future lease income and receives money from sale of the assets today.

The income from the various leases would be aggregated and pooled, and new securities (bonds) issued based on these. The

tangible benefit from securitisation occurs when the pooled assets are divided into tranches and tranches are credit rated. The

higher rated tranches would carry less risk and have less return, compared to lower rated tranches. If default occurs, the

income of the lower tranches is reduced first, before the impact of increasing defaults move to the higher rated tranches. This

allows an asset of low liquidity to be converted into securities which carry higher liquidity.

Ennea Co would face a number of barriers in undertaking such a process. Securitisation is an expensive process due to

management costs, legal fees and ongoing administrative costs. The value of assets that Ennea Co wants to sell is small and

therefore these costs would take up a significant proportion of the income. High cost implications mean that securitisation is

not feasible for small asset pools.

Normally asset pools would not offer the full value of the asset as securities. For example, only 90% of the asset value would

be converted into securities, leaving the remaining 10% as a buffer against possible default. This method of credit

enhancement would help to credit-rate the tranches at higher levels and help their marketability. However, Ennea Co would

not be able to take advantage of the full asset value if it proceeds with the asset securitisation.

(Note: credit will be given for alternative relevant comments and suggestions)

(c) Reducing the amount of debt by issuing equity and using the cash raised from this to reduce the amount borrowed changes

the capital structure of a company and Sembilan Co needs to consider all the possible implications of this.

As the proportion of debt increases in a company’s financial structure, the level of financial distress increases and with it the

associated costs. Companies with high levels of financial distress would find it more costly to contract with their stakeholders.

For example, they may have to pay higher wages to attract the right calibre of employees, give customers longer credit periods

or larger discounts, and may have to accept supplies on more onerous terms. Furthermore, restrictive covenants may make

it more difficult to borrow funds (debt and equity) for future projects. On the other hand, because interest is payable before

tax, larger amounts of debt will give companies greater taxation benefits, known as the tax shield. Presumably, Sembilan Co

has judged the balance between the levels of equity and debt finance, such that the positive and negative effects of gearing

result in minimising the required rate of return and maximising the value of the company.

By replacing debt with equity the balance may no longer be optimal and therefore the value of Sembilan Co may not be

maximised. However, reducing the amount of debt would result in a higher credit rating for the company and reduce the scale

of restrictive covenants. Having greater equity would also increase the company’s debt capacity. This may enable the company

to raise additional finance and undertake future profitable projects more easily. Less financial distress may also reduce the

costs of contracting with stakeholders.

The process of changing the financial structure can be expensive. Sembilan Co needs to determine the costs associated with

early redemption of debt. The contractual clauses of the bond should indicate the level and amount of early redemption

penalties. Issuing new equity can be expensive especially if the shares are offered to new shareholders, such as costs

associated with underwriting the issue and communicating or negotiating the share price. Even raising funds by issuing rights

can be expensive.

As well as this, Sembilan Co needs to determine the extent to which the current shareholders will be able to take up the rights

and the amount of discount that needs to be given on the rights issue to ensure 100% take up. The impact on the current

share price from the issue of rights needs to be considered as well. Studies on rights issues seem to indicate that the markets

view the issue of rights as a positive signal and the share price does not reduce to the expected theoretical ex-rights price.

However, this is mainly because the markets expect the funds raised to be used on new, profitable projects. Using funds to

reduce the debt amount may not be viewed so positively.

Sembilan Co may also have to provide information and justification to the market because both the existing shareholders and

any new shareholders will need to be assured that the company is not benefiting one group at the expense of the other. If

sufficient information is not provided then either shareholder group may discount the share price due to information

asymmetry. However, providing too much information may reduce the competitive position of the company.

(Note: credit will be given for alternative relevant comments and suggestions)

(c) 99% confidence level requires the value at risk (VAR) to be within 233 standard deviations from the mean, based on a single

tail measure.

Annual VAR = 233 x $800,000 = $1,864,000

Five year VAR = $1,864,000 x 5

1/2

approx. = $4,168,000

The figures mean that Elfu Co can be 99% confident that the cash flows will not fall by more than $1,864,000 in any one

year and $4,168,000 in total over five years from the average returns. Therefore the company can be 99% certain that the

returns will be $336,000 or more every year [$2,200,000 $1,864,000]. And it can be 99% certain that the returns will

be $6,832,000 or more in total over the five-year period [$11,000,000 $4,168,000]. There is a 1% chance that the

returns will be less than $336,000 each year or $6,832,000 over the five-year period.

5 (Solution note: The following answer for question 5(a) is indicative. Credit will be given for alternative suggestions of risks and

issues, and their management or control.)

(a) Kilenc Co needs to consider a number of risks and issues when making the decision about whether or not to set up a

subsidiary company in Lanosia. It should then consider how these may be managed or controlled.

Key Risks/Issues

Kilenc Co needs to assess the impact on its current exports to Lanosia and the nearby countries if the subsidiary is set up.

Presumably, products are currently exported to these countries and if these exports stop, then there may be a negative impact

on the employees and facilities currently employed in this area. Related to this may be the risk of loss of reputation if the

move results in redundancies. Furthermore, Kilenc Co should consider how the subsidiary and its products would be seen in

Lanosia and the nearby countries. For example, would the locally made products be perceived as being of comparative quality

as the imported products?

The recession in Lanosia may have a negative impact on the market for the products. The cost of setting up the subsidiary

company needs to be compared with the benefits from extra sales revenue and reduced costs. There is a risk that the

perceived benefits may be less than predicted or the establishment of a subsidiary may create opportunities in the future once

the country recovers from the recession.

Currently the government offers support for companies involved in the pharmaceutical industry. Kilenc Co may find it difficult

to set up the subsidiary if it is viewed as impeding the development of the local industry by the government. For example,

the government may impose restrictions or increase the taxes the subsidiary may have to pay. On the other hand, the

subsidiary may be viewed as supporting the economy and the growth of the pharmaceutical industry, especially since 40%

of the shares and 50% of the Board of Directors would be in local hands. The government may even offer the same support

as it currently offers the other local companies.

20Kilenc Co wants to finance the subsidiary through a mixture of equity and debt. The implications of raising equity finance are

discussed in part (b) of the question. However, the risks surrounding debt finance needs further discussion. Raising debt

finance in Lanosia would match the income generated in Lanosia with debt interest payments, but the company needs to

consider whether or not it would be possible to borrow the money. Given that the government has had to finance the banks

may mean that the availability of funds to borrow may be limited. Also interest rates are low at the moment but inflation is

high, this may result in pressure on the government to raise interest rates in the future. The consequences of this may be that

the borrowing costs increase for Kilenc Co.

The composition of the Board of Directors and the large proportion of the subsidiary’s equity held by minority shareholders

may create agency issues and risks. Kilenc Co may find that the subsidiary’s Board may make decisions which are not in the

interests of the parent company, or that the shareholders attempt to move the subsidiary in a direction which is not in the

interests of the parent company. On the other hand, the subsidiary’s Board may feel that the parent company is imposing too

many restrictions on its ability to operate independently and the minority shareholders may feel that their interests are not

being considered by the parent company.

Kilenc Co needs to consider the cultural issues when setting up a subsidiary in another country. These may range from cultural

issues of different nationalities and doing business in the country to cultural issues within the organisation. Communication

of how the company is organised and understanding of cultural issues is very important in this case. The balance between

independent autonomy and central control needs to be established and agreed.

Risks such as foreign exchange exposure, product health and safety compliance, employee health and safety regulations and

physical risks need to be considered and assessed. For example, foreign exchange exposures arising from exporting the

products to nearby countries need to be assessed. The legal requirements around product health and safety and employee

health and safety need to be understood and complied with. Risks of physical damage such as from floods or fires on the

assets of the business need to be established.

Mitigating the Risks and Issues

A full analysis of the financial costs and benefits should be undertaken to establish the viability of setting up the subsidiary.

Sensitivity and probability analysis should be undertaken to assess the impact and possibility of falling revenues and rising

costs. Analysis of real options should be undertaken to establish the value of possible follow-on projects.

Effective marketing communication such as media advertising should be conducted on the products produced by the

subsidiary to ensure that the customers’ perceptions of the new products do not change. This could be supported by retaining

the packaging of the products. Internal and external communication should explain the consequences of any negative impact

of the move to Lanosia to minimise any reputational damage. Where possible, employees should be redeployed to other

divisions, in order to minimise any negative disruption.

Negotiations with the Lanosian government should be undertaken regularly during the process of setting up the subsidiary to

minimise any restrictions and to maximise any benefits such as favourable tax rates. Where necessary and possible, these

may be augmented with appropriate insurance and legal advice. Continuing lobbying may also be necessary after the

subsidiary has been established to reduce the possibility of new rules and regulations which may be detrimental to the

subsidiary’s business.

An economic analysis may be conducted on the likely movements in inflation and interest rates. Kilenc Co may also want to

look into using fixed rate debt for its long-term financing needs, or use swaps to change from variable rates to fixed rates. The

costs of such activity need to be taken into account.

Clear corporate governance mechanisms need to be negotiated and agreed on, to strike a balance between central control

and subsidiary autonomy. The negotiations should involve the major parties and legal advice may be sought where necessary.

These mechanisms should be clearly communicated to the major parties.

The subsidiary organisation should be set up to take account of cultural differences where possible. Induction sessions for

employees and staff handbooks can be used to communicate the culture of the organisation and how to work within the

organisation.

Foreign exchange exposure, health and safety regulation and risk of physical loss can be managed by a combination of

hedging, insurance and legal advice.

(b) Dark pool trading systems allow share orders to be placed and matched without the traders’ interests being declared publicly

on the normal stock exchange. Therefore the price of these trades is determined anonymously and the trade is only declared

publicly after it has been agreed. Large volume trades which use dark pool trading systems prevent signals reaching the

markets in order to minimise large fluctuations in the share price or the markets moving against them.

The main argument put forward in support of dark pool trading systems is that by preventing large movements in the share

price due to volume sales, the markets’ artificial price volatility would be reduced and the markets maintain their efficiency.

The contrary arguments suggest that in fact market efficiency is reduced by dark pool trading systems because such trades

do not contribute to the price changes. Furthermore, because most of the individuals who use the markets to trade equity

shares are not aware of the trade, transparency is reduced. This, in turn, reduces the liquidity in the markets and therefore

may compromise their efficiency. The ultimate danger is that the lack of transparency and liquidity may result in an

uncontrolled spread of risks similar to what led to the recent global financial crisis.

21It is unlikely that the dark pool trading systems would have an impact on Kilenc Co’s subsidiary company because the

subsidiary’s share price would be based on Kilenc Co’s share price and would not be affected by the stock market in Lanosia.

Market efficiency in general in Lanosia would probably be much more important.

相关推荐:

ACCA教材辅导讲义——Pilotpapers for F3

更多ACCA考试信息请关注读书人网(http://www.reader8.net/)

ACCA频道(http://www.reader8.net/exam/acca/)