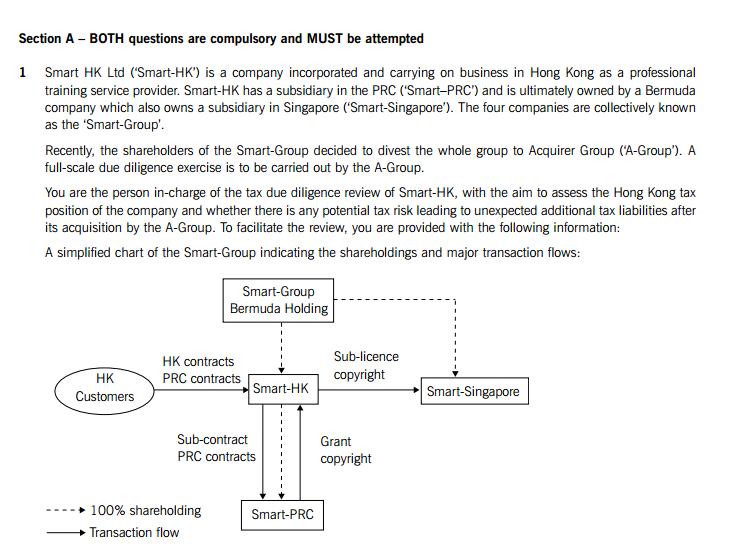

sub-contract fee payable to Smart-PRC is agreed at 80% of the gross service fee under the PRC Contracts. For

each training session, experienced trainers are sent from Smart-HK to assist Smart-PRC, but no cost is charged

for this by Smart-HK. Other support provided in Hong Kong for the PRC Contracts include liaison with customers,

arranging itinerary etc. None of the customers are related to the Smart-Group, and all the service contracts (both

HK and PRC Contracts) are negotiated and signed in Hong Kong.

(2) Smart-PRC is responsible for preparing the relevant training materials for use in the training sessions. It has been

agreed that the copyright for these materials will remain with Smart-PRC. By virtue of the licence agreement

between Smart-PRC and Smart-HK, Smart-HK is granted the right to use the training materials in Hong Kong

and Singapore. The royalty payable is based on 3% of the training revenue received. Smart-HK has entered into

a sub-licence agreement with Smart-Singapore under which Smart-Singapore is allowed to use the training

materials for a royalty at 10% of the training revenue received.

(3) Smart-PRC is the wholly-owned subsidiary of Smart-HK. Each year, Smart-HK has recorded a considerable

amount of dividend income from Smart-PRC. Based on the management representation, Smart-PRC has been

making a very good return from its investment activities in the PRC, and these investments are mainly funded

by the large amount of cash received from Smart-HK by way of sub-contract fees.

Required:

As the tax advisor of Acquirer Group in charge of the tax due diligence review, prepare a report for the directors

of Acquirer Group, addressing the Hong Kong tax issues set out below relating to Smart-HK, including supporting

calculations where appropriate.

(i) The Hong Kong profits tax implications of the training fee revenue from the PRC Contracts and the

sub-contract fee payable to Smart-PRC. Your report should cover the contemporary principles/rules

determining the taxability of the net income of $200,000 from the PRC training service, the arguments both

for and against the offshore claim made by Smart-HK, the role played by Smart-PRC and whether you agree

with the current profits tax treatments by Smart-HK;

Note: For the purpose of this part only, you should assume that all amounts are charged on an arm’s length

basis. (14 marks)

(ii) Assuming that the training fees from the PRC Contracts are taxable in Hong Kong, the Hong Kong profits tax

implications, if any, to Smart-HK of the sub-contract fee paid to Smart-PRC, taking into account the current

transfer pricing rules and practices in Hong Kong. Your report should cover the current views of the Inland

Revenue Department on charges made between associated enterprises, as set out in Departmental

Interpretation and Practice Note (DIPN) 46 ‘Transfer pricing guidelines Methodologies and related issues’;

Note: You are NOT required to make detailed references to the Double Taxation Arrangement between

Hong Kong and the PRC. (10 marks)

(iii) Assuming that Smart-PRC is not carrying on business in Hong Kong, the Hong Kong profits tax implications

to Smart-PRC in respect of the royalty received and the Hong Kong tax compliance obligations of Smart-HK

in this context; (6 marks)

(iv) Other than the potential technical risks as discussed above, any other information that you would request

from Smart-HK in order for you to assess its level of tax compliance in the context of the Hong Kong tax

regime, giving brief explanations as to why the information is required. (6 marks)

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the

report and the effectiveness with which its advice is communicated. (4 marks)

(40 marks)

5 [P.T.O.2 Mr Chan, a Malaysian, has been working in Hong Kong for World Ltd, a company resident in Hong Kong (the

‘Company’) since 1 April 2004, at a monthly salary of $80,000. Due to a failure in an important business project,

Mr Chan was asked to resign and he submitted his resignation letter to the Company’s director on 31 March 2012,

notifying that he would terminate his employment with effect from 1 April 2012. However, his official last day of work

in the Company would be 29 March 2012, after deducting two days of entitled annual leave.

Other details of Mr Chan’s termination arrangement and payment are as follows:

(I) His total termination payment represented the following:

(i) his final salary accrued up to 31 March 2012;

(ii) compensation for the remaining balance of his entitled annual leave days as at 31 March 2012 of 15 days,

of $40,000;

(iii) compensation for loss of office as agreed with the Company’s director, representing one month of his salary.

It has been the practice of the Company to pay an annual discretionary bonus equivalent to one month’s

salary;

(iv) his entitlement payment from the Company’s provident fund registered under the Occupational Retirement

Scheme Ordinance in the amount of $300,000 (Mr Chan and the Company had contributed equal amounts

to the provident fund). The accrued benefit attributable to Mr Chan’s service was $120,000; and

(v) compensation for the loss incurred by him from having to sell his car in Hong Kong as a result of his

termination of $10,000.

(II) The Company’s director agreed to pay Mr Chan an extra sum of compensation of $200,000 after six months

from the date of his termination on the condition that he did not work for the Company’s competitors during this

period.

Mr Chan is planning to move back to Malaysia. Before he goes back, he is interested in investing in residential

properties in Hong Kong. With various ideas in mind, he has approached you for advice on how to plan his investment

in a tax effective manner. His plans and ideas are:

(1) He will acquire one or two residential units in Tsimshatsui and lease them out for rental.

(2) The acquisitions will be financed partly by his personal savings (around 50%) and partly by bank mortgage

loans. It is expected that the rental income will not be sufficient to cover the mortgage interest.

(3) The residential units need to be renovated before they can be leased out. A substantial amount of renovation

costs is expected to be incurred after the acquisition.

(4) In two to five years’ time, he may consider disposing of the units if property prices go up to a satisfactory level.

(5) He has no idea as to how the properties should be owned, by an individual or by a special purpose company.

However, for the former, he prefers to have the properties owned by his daughter who is single, has always been

living in the UK and has no connection with Hong Kong. He believes that this will lead to a tax-free position in

respect of the rental received. Alternatively, he is considering setting up a company in an offshore tax haven to

hold the properties so that Hong Kong tax can be avoided; with minimal local tax payable in the tax haven

country.

6Required:

(a) Advise Mr Chan of the general principles used for determining the taxability of each item of the termination

payment received upon his cessation of employment.

Note: You are NOT required to calculate his assessable/chargeable income or tax payable. (14 marks)

(b) Compare the tax implications for the rental income received from the residential units if the properties are

held by:

(i) an individual; and (3 marks)

(ii) a special purpose company. (4 marks)

(c) Comment on the extent to which the tax planning ideas as described in note 5 above are feasible.

(3 marks)

(d) Explain the tax implications arising from the disposal of the residential units in two to five years’ time,

including how these may be affected by the different ownership structures. (6 marks)

(30 marks)

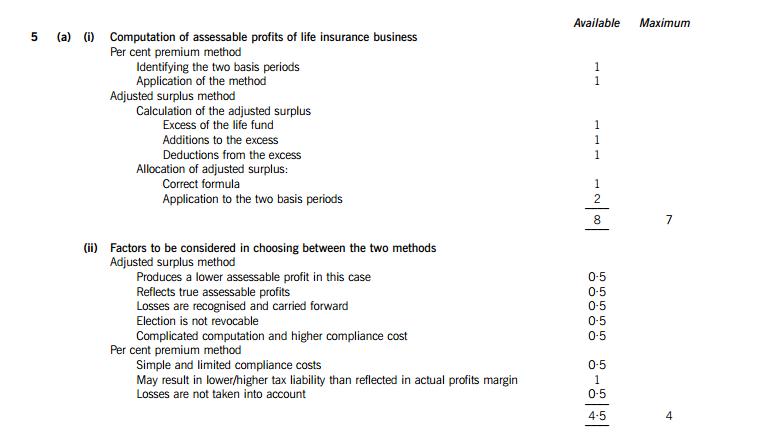

Section B TWO questions ONLY to be attempted

3 Mr Hui is working as the Regional IT Manager for GA Ltd (‘GAL’), a company incorporated and carrying on general

insurance business in Hong Kong. As of 31 August 2012, Mr Hui will have reached the retirement age. He has been

requested by his boss to extend his employment services for another two years, but with the following proposed

changes in his appointment terms:

(1) The employment contract between Mr Hui and GAL will be terminated with effect from 1 September 2012.

(2) Mr Hui will set up a consulting company which will enter into a service agreement with GAL. Under the service

agreement, the consulting company is obliged to provide IT related services to GAL and Mr Hui is designated as

the individual to provide the required services.

(3) In return for the services provided by Mr Hui, GAL will pay a monthly fee to the consulting company in an amount

equivalent to the monthly salary that Mr Hui currently receives. The payment will be made by direct bank transfer

into the consulting company’s bank account. Moreover, a profit-sharing bonus will be payable to the consulting

company on an annual basis, calculated based on the performance of GAL’s business for that year.

(4) Under the same service agreement, Mr Hui will be provided with an office together with secretarial and

administrative support by GAL. However, he will not be allowed to take vacation for more than 30 days in a year.

(5) During the period of providing services to GAL, Mr Hui will continue to hold the title of Regional IT Manager, and

will remain under the instruction and supervision of GAL’s Group IT Director, Mr Hui’s current boss.

(6) The service agreement also explicitly mentions that GAL does not act as the employer of Mr Hui and thus is not

obliged to comply with any necessary employment regulations and reporting obligations. Mr Hui will undertake

to enter into a separate employment contract with his consulting company so as to enable him to provide the

required services to GAL. However, GAL will not be involved in, or responsible for, the arrangement between

Mr Hui and his consulting company.

Required:

(a) Explain the criteria that the Inland Revenue Department will use to determine whether the proposed changes

to Mr Hui’s appointment terms will be acceptable as a contract for consultancy services rather than of

employment. Clearly identify the extent to which the terms specified in items (1) to (6) do/do not support the

contention that GA Ltd no longer acts as Mr Hui’s employer. (11 marks)

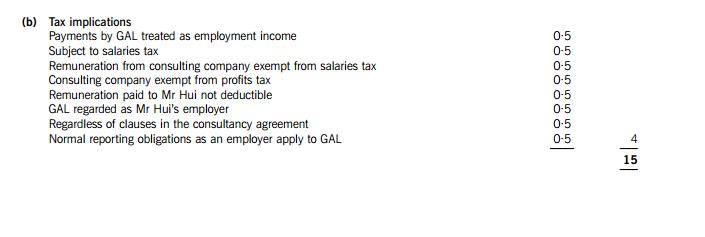

(b) Assuming that the Inland Revenue Department considers that Mr Hui remains an employee of GA Ltd after

1 September 2012, advise on the tax implications, if any, including any compliance obligations imposed

under the Inland Revenue Ordinance for Mr Hui, his consulting company and GA Ltd. (4 marks)

(15 marks)

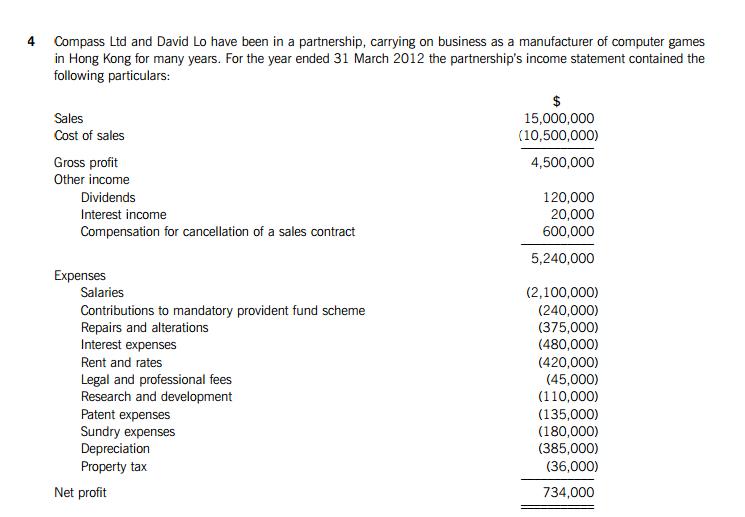

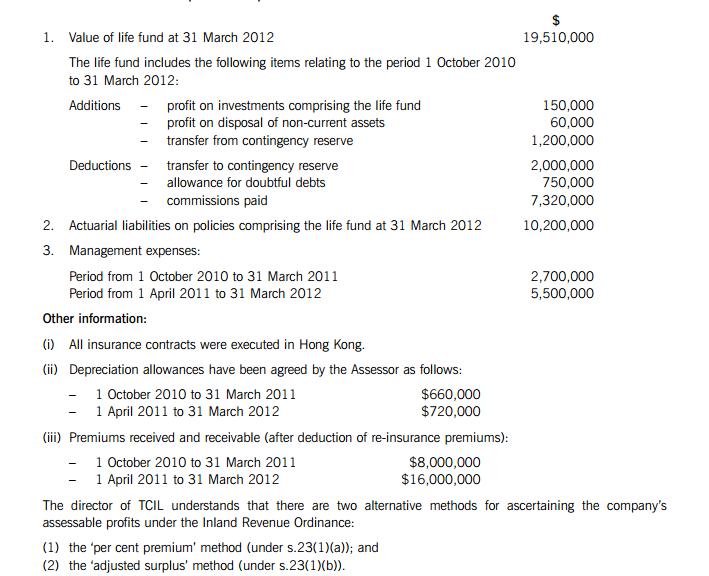

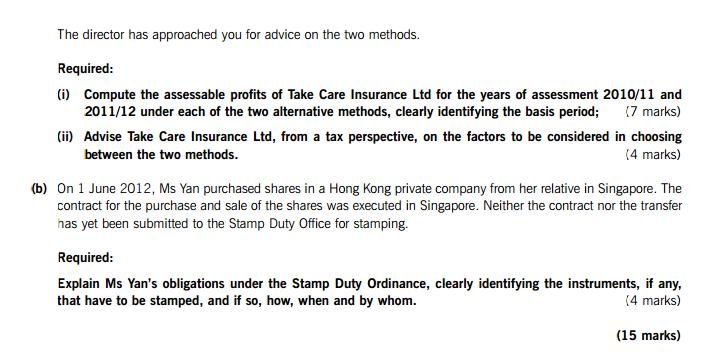

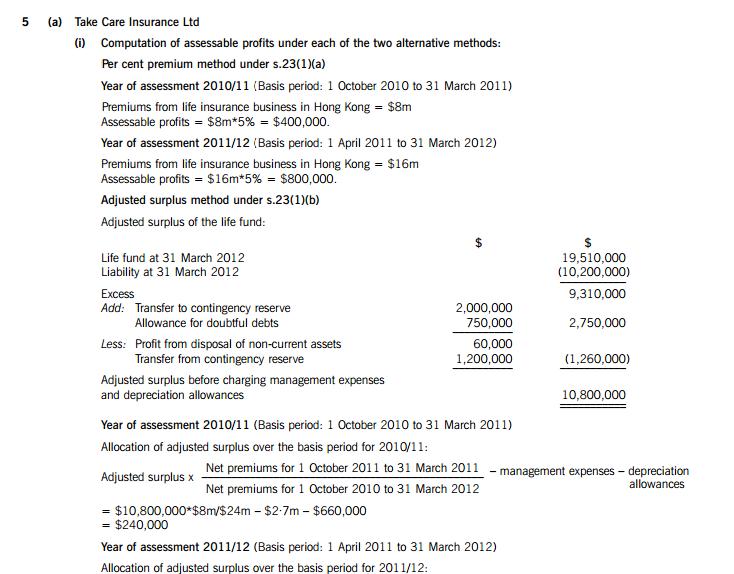

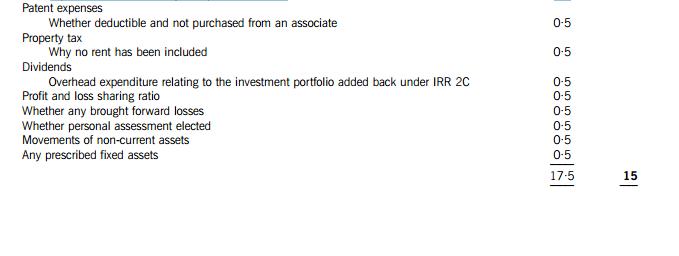

Required:

State, with reasons, the additional information that you would require in order to determine the profits tax payable

by the partnership business for the year of assessment 2011/12.

(15 marks)

End of Question Paper

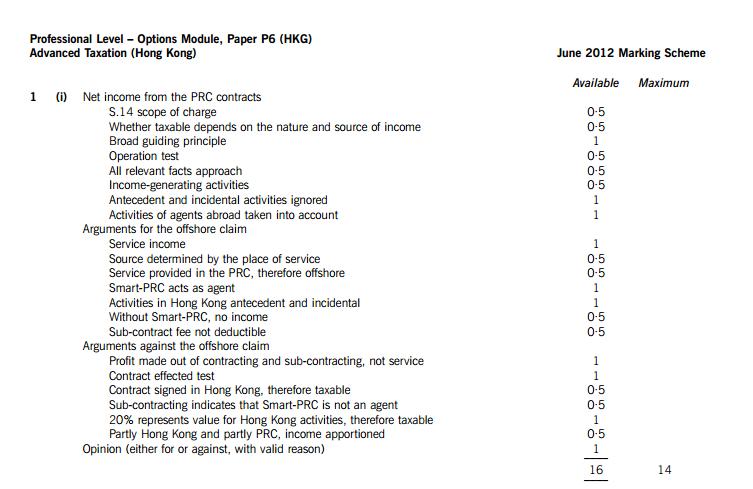

(i) Hong Kong profits tax implications of the profits arising from the PRC Contracts

Based on s.14 of the Inland Revenue Ordinance (IRO), profits tax is charged on every person carrying on a trade, profession

or business in Hong Kong in respect of his assessable profits arising in or derived from Hong Kong from such trade, profession

or business. As Smart-HK is carrying on business in Hong Kong, the first test of the two limbs is satisfied. However, whether

an amount of profit derived by Smart-HK is taxable in Hong Kong depends on whether the profit is sourced in Hong Kong,

i.e. the second test which in turn depends on the nature of the profit. According to the Departmental Interpretation and

Practice Note (DIPN) 21 (revised 2009), the broad guiding principle is ‘one looks to see what the taxpayer has done to earn

the profits in question and where he has done it’ (basing on CIR v Hang Seng Bank Ltd and CIR v HK-TVB International

Ltd). This is the so-called ‘operations test’. However, how to identify the activities that produced the relevant profits in order

to ascertain where those activities took place is a contentious issue. Various approaches have been derived from different

court cases, although it has been the view of the Inland Revenue Department (IRD) that the ‘totality of facts’ be looked at,

that is, all the activities of a business leading to the earning of the profit. However, this approach has been criticised (in cases

such as ING Baring Securities (HK) Ltd v CIR and CIR v Li & Fung (Trading) Ltd) and the courts have suggested that weighting

should only be given to those profit-generating activities that directly give rise to the profits earned, and all other activities

antecedent or incidental to the profit-generating activities should be ignored. Moreover, that the ‘activities of any person abroad

who undertakes the relevant profit generating transactions on behalf of, and on the instructions of the taxpayer, even if that

person is not an agent of the taxpayer’ should also be taken into account (ING Baring).

Given the contentious development of the source rule as mentioned above, it would not be straightforward to conclude that

the profits of Smart-HK earned from the training services sub-contracted to Smart-PRC are offshore and non-taxable. Below

is a list of arguments that may possibly be used to challenge or defend against the offshore claim:

Arguments for the offshore claim

(1) The nature of profits derived by Smart-HK from the provision of training services is service income. Based on DIPN 21,

the source of profits from the provision of a service is determined by the place where the service is performed. Since the

training services are conducted in the PRC via Smart-PRC, the profits from the provision of such services should be

sourced in the PRC and thus not taxable in Hong Kong.

(2) Based on ING Baring, the activities giving rise to the relevant gross profit earned by Smart-HK are the performing of

training services in discharge of its obligations under the PRC contracts, and these obligations are primarily the provision

of training sessions in the PRC for the customers’ staff in the PRC. All these obligations are then sub-contracted to

Smart-PRC which agrees to fulfil these obligations on behalf of Smart-HK. Smart-PRC is effectively acting on behalf of

Smart-HK and is an ‘agent’ of Smart-HK, even if there is no legal agency agreement in writing. Pursuant to the ING

Baring case, because the training services by Smart-PRC are provided on behalf of Smart-HK, they should be taken into

account in identifying the activities carried out by Smart-HK in deriving the profits and where such activities were carried

out.

(3) We assume Smart-HK has minimal involvement in the provision of the services in earning the PRC training fee revenue

except that it sends experienced trainers to assist Smart-PRC. However, no charge is made to Smart-PRC, indicating that

Smart-HK is prepared to take the responsibility to assure the quality performance of the PRC training sessions. All other

supporting activities conducted by Smart-HK in Hong Kong, including liaison with customers, arranging itinerary, etc,

are antecedent as well as incidental to the training services in the PRC. Based on ING Baring and Li & Fung, these

antecedent and incidental activities should be ignored, and thus all profits arising from the PRC contracts are sourced

offshore and should not be assessable to profits tax in Hong Kong.

15(4) The role played by Smart-PRC is fundamental and crucial to the earning of the training fee by Smart-HK. In the absence

of the services provided by Smart-PRC in the PRC, Smart-HK would not have been able to earn the training fee.

(5) Since the training fees under the PRC contracts are totally offshore and non-taxable, the sub-contract fee paid to

Smart-PRC is not incurred in the production of assessable profits, and thus not tax deductible. As a result, the net

income of $200,000 is not taxable.

Arguments against the offshore claim

(1) Smart-HK is making profits out of contracting and sub-contracting activities. It is effectively earning a spread between

the training fee from the customer and the sub-contract fee paid to Smart-PRC, rather than earning a service-type of

profit from the provision of a service. The source of the spread should not be determined by the place where the service

is performed, but by the place where the contract is effected. Since the PRC contracts are negotiated and signed in

Hong Kong, the income from the contracts would therefore be sourced in Hong Kong and taxable.

(2) Depending on the terms in the sub-contract, the obligations under the PRC contracts were sub-contracted out to

Smart-PRC, suggesting that Smart-PRC is the sub-contractor engaged by Smart-HK, not an agent of Smart-HK.

Smart-PRC has its own business established in the PRC, and it takes on its own business and contract risk under the

sub-contract agreement. The sub-contracting fee paid to Smart-PRC should represent the value of the services provided

by Smart-PRC, which is 80% of the gross contract fee from the customers. This indicates that the difference, being 20%,

should represent the value or reward for the activities performed by Smart-HK in Hong Kong, including its decision and

management, liaison work and supporting activities. As a result, the difference of 20%, or $200,000, should be onshore

and thus, taxable in Hong Kong.

(3) It would seem that the obligations required under the PRC contracts are partly done in Hong Kong and partly in the

PRC. The total income should be apportioned based on each party’s contribution.

Taking the above into account, on balance, we are inclined to opine that Smart-HK is likely to be challenged by the IRD on

the offshore claim. This is not only based on the current IRD practice that all relevant facts be examined as per DIPN 21, but

also because the extent to which the Court of First Instance’s decision in Li & Fung will be affirmed by the more senior courts

upon appeal is still uncertain. We would recommend that the potential tax liabilities and penalty thereon should be reflected

in the acquisition price of the Smart-Group.

(ii) Hong Kong profits tax implications to Smart-HK of the sub-contract fee paid to Smart-PRC

Under the arrangement, Smart-HK sub-contracts the obligations under the PRC contracts to Smart-PRC, at a fee equivalent

to 80% of the gross contract fee received from the customer by Smart-HK. Assuming that the gross contract fee is taxable

pursuant to the IRO, a tax deduction can be claimed for the 80% sub-contract fee paid to Smart-PRC. Based on s.16(1) of

the IRO, expenses or outgoings will be allowed to the extent they are incurred in the production of assessable profits.

Therefore, if evidence is adequate to prove that the sub-contract fee was paid for the services provided by Smart-PRC to

enable Smart-HK to earn the gross contract fee, the sub-contract fee is prima facie tax deductible.

By virtue of DIPN 46 (issued in December 2009), the IRD has expressed its views on how, and to what extent, a transaction

between associated enterprises should be conducted. When two associated enterprises are carrying on business with each

other, the transfer price charged for the transfer of goods, services and intangible property is expected to be at arm’s length.

Two enterprises are regarded as associated if one enterprise participates directly or indirectly in the management, control or

capital of the other enterprise, or the same persons participate directly or indirectly in the management, control or capital of

both enterprises. However, DIPN 46 makes no reference to the shareholding threshold or residency. In the context of

Smart-HK, as Smart-PRC is wholly owned by Smart-HK, they would be regarded as associated enterprises in the context of

transfer pricing. The basis and quantum for the sub-contract fee payable by Smart-HK to Smart-PRC would be expected to

be at arm’s length.

A price is regarded as at arm’s length if the price transacted between the associated enterprises is comparable to the price

transacted by independent enterprises dealing with each other in similar transactions. If any deviation is found from the arm’s

length basis, a tax adjustment may be made by the IRD to bring the income or expense, as the case may be, back to the

arm’s length level. In the case of Smart-HK, it would be important to ascertain and justify with proper documentation that

the 80% sub-contract fee is commensurate with the value of services provided by Smart-PRC. The most common

methodologies, comparable uncontrolled price and cost-plus pricing, may be used to ascertain what the arm’s length price

should be. The Smart-Group should be asked to provide any information that may be available to enable a transfer pricing

review to be conducted. Should a transfer pricing review be done, efforts should be made to ensure that proper documentation

is maintained.

In the event that the 80% basis is found to be excessive, it is likely that the IRD would apply s.16(1) to restrict the amount

of tax deduction for the sub-contract fee to the amount determined as arm’s length. Although the authority to restrict the

amount of tax deduction under s.16(1) has been challenged by the court (Ngai Lik Electronics Co Ltd v CIR), it is still believed

that the IRD would follow this approach as mentioned in DIPN 46. Alternatively, the IRD may choose to rely on Article 9

(Associated Enterprises Article) of the Double Taxation Arrangement between Hong Kong and the PRC, to adjust upwards the

profits of Smart-HK according to the market price benchmarked to an independent transaction.

In a situation where the IRD considers that Smart-HK and Smart-PRC are engaged in a tax avoidance arrangement in order

to obtain a tax benefit, the IRD may impose s.61 and/or s.61A and/or s.20 to counteract the tax benefit obtained/otherwise

obtainable. In the case of Smart-HK, it is in doubt whether the sub-contract fee is deliberately overstated so as to provide

16sufficient funds for Smart-PRC to finance its investment activities in the PRC, in return for which Smart-HK shares the return

of the investment activities by way of an excessive dividend which is non-taxable in Hong Kong. Further investigation is

recommended in order to form an opinion as to whether a potential risk of s.61 and/or s.61A and/or s.20 being invoked by

the IRD exists.

(iii) Hong Kong profits tax implication of the royalty income received by Smart-PRC

The taxability of the royalty received by Smart-PRC from Smart-HK for the use of copyright in Hong Kong and Singapore is

governed by s.15 of the IRO. As Smart-PRC is not carrying on business in Hong Kong, the royalty it receives will not fall

within the scope of s.14, but s.15. Under s.15(1)(b), any payments received for the use of, or right to use, in Hong Kong a

patent, design, trademark, copyright material, secret process or formula or any similar property or for imparting know-how in

connection with the use of any of those properties are deemed to be receipts arising in Hong Kong from a trade, profession

or business carried on in Hong Kong. In the case where the right to use is offshore Hong Kong, s.15(1)(ba) taxes a royalty

payment for use outside Hong Kong if the royalty payment is claimed as tax deductible in Hong Kong. In the case of

Smart-PRC, the royalty received for the use of the copyright in Hong Kong in the training sessions conducted by Smart-HK

in Hong Kong would fall within s.15(1)(b) and thus be taxable. 30% of the gross royalty received is deemed to be assessable

profits of Smart-PRC. Based on the figures provided, the estimated tax is $445 ($9,000 x 30% x 165%). Smart-HK is

deemed to be acting as the agent of Smart-PRC and is obliged to file the appropriate tax return on behalf of Smart-PRC,

withhold the tax amount from the payment before it is made to Smart-PRC, and pay the tax amount to the IRD on behalf of

Smart-PRC. Failure to do so would trigger a penalty. It is recommended that Smart-HK be requested to provide evidence that

these reporting and withholding obligations have been duly complied with.

In respect of the royalty paid for the use of the copyright in Singapore by Smart-Singapore, since Smart-HK has sought to

claim the royalty from Smart-Singapore as offshore and non-taxable and thus has not claimed the related royalty payment to

Smart-PRC as tax deductible in Hong Kong, Smart-PRC would not be liable to Hong Kong profits tax in respect of the

Singapore-sourced royalty income unless Smart-HK’s aforesaid claim fails. No compliance obligation is required.

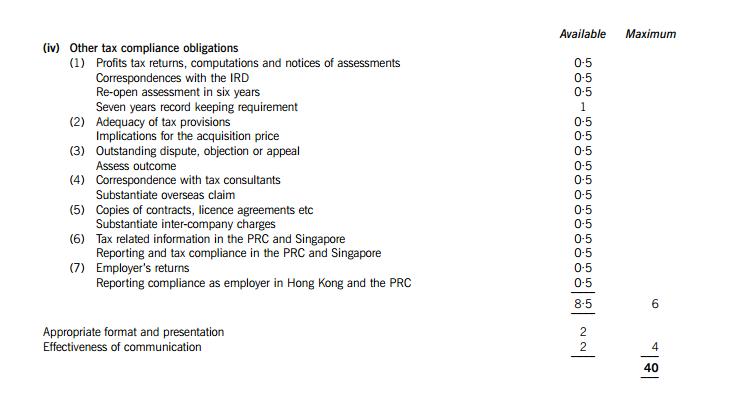

(iv) Other tax compliance obligations in Hong Kong

Other than the above-mentioned technical risks which may potentially expose Smart-HK to additional tax risks, it is also

important to assess the tax compliance level of Smart-HK itself. In the absence of a satisfactory level of tax compliance or

reporting, Smart-HK is potentially subject to challenge by the IRD, leading to tax payable on additional assessments and

possibly a penalty. The following is a list of information required for further review, together with relevant explanations:

(1) All Hong Kong profits tax returns, computations, notices of assessments (including revised, additional assessments and

notices for provisional payment of taxes), and copies of all correspondence between the IRD and Smart-HK for the past

seven years. This information would enable us to obtain the overall tax position of the company and the level to which

such tax positions have been accepted by the IRD. Seven years’ records are required because the IRD has the authority

to re-open the assessment for any year within six years. Therefore, any assessment within this statutory time limit carries

the same risk. Moreover, Smart-HK is also obliged under the tax law to maintain a good record of its business for not

less than seven years.

(2) By reviewing the tax computations and assessments issued, the nature of tax adjustments made by the IRD would give

an indication of the extent of the tax aggressiveness of Smart-HK in dealing with the IRD. More importantly, it would

help assess the level of adequacy of the company’s tax provisions made to date. Excessive understatement (and/or

overstatement) of tax provisions may have significant implications for the acquisition value of the company.

(3) The records of correspondence with the IRD would indicate whether there is any outstanding dispute or objection with

the IRD, or appeal to the Board of Review or even the courts. If so, the issue in dispute and the possible outcome would

need to be further assessed. Moreover, details of prior years’ legal and professional fees would help reveal whether there

are any undisclosed tax disputes.

(4) Copies of correspondence with all tax consultants engaged by Smart-HK may help to explain the mode of operation of

Smart-HK, especially the role played by Smart-PRC. This is required in order to provide a defence against any future

challenge from the IRD on the offshore claim for the fee under the PRC contracts.

(5) Copies of contracts, licence agreements and documentation supporting the basis of charge between Smart-HK and other

associates. These are important documents to substantiate the inter-company transactions in the case of challenge by

the IRD.

(6) Any other reporting documents and tax payment proof, if any, filed with or issued by the local tax authorities in both the

PRC and Singapore for transactions between Smart-HK and its associates. These documents may relate to, amongst

others, the PRC withholding tax paid, if any, on the dividend paid from Smart-PRC, Singapore withholding tax paid, if

any, on the royalty from Smart-Singapore, foreign exchange clearance of funds remitted into and out of the PRC or

Singapore, etc. These are required to assess whether, and to what extent, Smart-HK is in compliance with the foreign

tax requirements.

(7) Any records and information, including employers’ returns filed with the IRD, to prove that Smart-HK has fully complied

with the employer’s reporting obligations in respect of its employees. If reporting has been made to the PRC tax authority

in respect of the trainers sent to support Smart-PRC, all related information should also be reviewed.

17The above observations are drawn based on the information provided, but it is considered that other relevant information is

required to enable us to assess the tax position of Smart-HK in further detail. Please help collate the information as mentioned

above for our further review. Should there be any questions regarding the above, we are pleased to meet with you and explain

in greater detail.

End of Report

2 Mr Chan

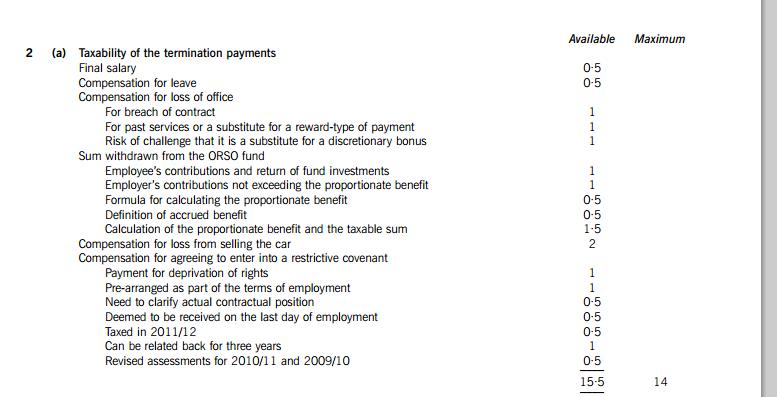

(a) Taxability of the termination payments

The Hong Kong salaries tax implications arising from the termination of Mr Chan’s employment are as follows:

(1) The terminal payment representing final salary is taxable as it is income from his employment by World Ltd (the

Company).

(2) Compensation for leave is also taxable on the basis that it is income from his employment by the Company.

(3) Compensation for loss of office may be argued as not taxable on the ground that it is a payment for breach of contract

rather than a payment for services rendered. For this ground to be valid, the ‘breach’ must be a real and identifiable

breach, and not a pre-arranged term under the employment contract. However, if the genuine reason for paying the

compensation is to recognise past services, or as a substitute for a reward-type of payment such as a bonus, the

compensation will be taxable.

In Mr Chan’s case, there is a risk of challenge by the Inland Revenue Department (IRD) that the compensation is

effectively a substitute for the discretionary bonus which is in practice equivalent to the compensation amount, both

being based on one month’s salary.

(4) The sum withdrawn from the Occupational Retirement Scheme Ordinance fund upon termination of service, to the extent

it represents previous contributions from the employee and the subsequent return of fund investments, is not taxable.

The portion of the sum withdrawn upon termination representing the employer’s contribution is also not taxable,

provided that it does not exceed the ‘proportionate benefit’ as calculated under the following formula:

Accrued benefit x (number of completed months of service)/120

Accrued benefit in the case of termination is defined as the maximum amount that the person would have been entitled

to receive had he retired at the termination date.

In Mr Chan’s case, as his employment with the Company is less than 120 months (96 months from April 2004 to March

2012), the proportionate benefit would be calculated as $96,000 ($120,000*96/120). Therefore, the Company’s

contribution which exceeds the proportionate benefit in the amount of $54,000 ($300,000/2 $96,000) needs to be

returned as taxable.

(5) The compensation is paid with the intention of covering the loss suffered by Mr Chan arising from the disposal of his

car in Hong Kong as a result of the termination of his employment. Given that he was actually ‘asked’ to terminate his

employment, the compensation could be argued to be a genuine compensation for the personal damage suffered by

him, which is not an expected reward for his services nor arising in connection with his employment. On this basis,

there is a strong case to argue that the compensation is not taxable.

(6) Compensation for agreeing to enter into a covenant restricting an employee’s activities is a payment for deprivation of

rights, not a payment for employment or services, and thus would not be taxable. However, there have been cases in

recent years illustrating that the IRD is now taking a stance that, if a compensation type of payment has been

pre-arranged as part of the terms of employment, it is, in reality, deferred remuneration from employment. Therefore,

despite its nature being compensation and its actual payment being post-termination, the compensation may be treated

as taxable. In Mr Chan’s case, it is uncertain whether the compensation for this restrictive covenant is in existence in

his employment contract. If it is already part of his employment terms, there is a risk that the IRD would treat it as

taxable.

In terms of the timing of receipt of the compensation being in six months’ time, s.11D provides that a payment from

employment after its termination would be deemed to be received on the last day of employment. Therefore, the

compensation for agreeing to enter into the restrictive covenant would be deemed to be paid on 31 March 2012,

Mr Chan’s last day of employment, and be taxed in the year of assessment 2011/12. However, should Mr Chan elect,

he may relate the compensation payment back for three years so that the sum would be spread over and brought to

assessment for the years of assessment 2011/12, 2010/11 and 2009/10 respectively. If necessary, revised

assessments would be issued for the years of assessment 2010/11 and 2009/10.

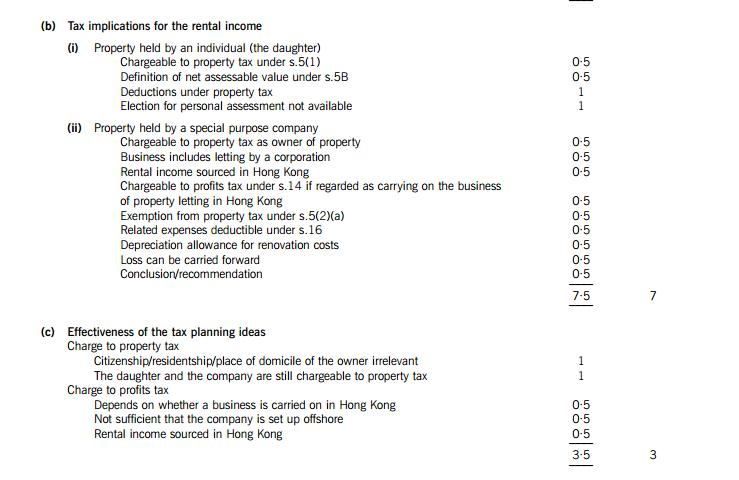

(b) Tax implications for the rental income received from properties

(i) If rental income is received from properties which are held by Mr Chan’s daughter as an individual, property tax is

payable under s.5(1). Under this section, property tax is levied on any owner of land or building or land and buildings

situated in Hong Kong, at the standard rate (15%) on the net assessable value of the property. ‘Net assessable value’

18as defined under s.5B includes any consideration payable in money or money’s worth in respect of the right to use the

land or/and buildings, as reduced by two types of deduction:

(a) government rates paid by the owner if it has been so agreed between the owner and the tenant; and

(b) a one-off statutory allowance of 20% of assessable value after deducting rates, if applicable. This statutory

allowance is deemed to cover all related expenses incurred by the owner on the property. All other actual expenses

incurred, such as repairs, management fees and mortgage interest, are not deductible for property tax purposes.

There is no deduction for mortgage interest for property tax. Upon election for personal assessment, the net assessable

value of the property can be reduced by the amount of mortgage interest down to zero, any excess mortgage interest not

so offset cannot be offset against other income, or carried backward or forward to other years (s.42). However, as

Mr Chan’s daughter is not a temporary or permanent resident in Hong Kong, she is not entitled to elect for personal

assessment (s.41).

(ii) If rental income is received from properties which are held by a special purpose company, s.5(1) is still applicable on

the basis that the company will be considered as ‘owner’ of the properties. Any rental income so received is subject to

property tax calculated in the same manner as for an individual (as explained in (i) above).

However, according to s.2, ‘business’ is defined to include the letting or sub-letting of property by a corporation.

Moreover, under s.14, any person who carries on a trade, profession or business in Hong Kong and derives assessable

profits in Hong Kong will be chargeable to profits tax. So in the case of the special purpose company, it will be regarded

as carrying on business by virtue of its property letting in Hong Kong, and it will be chargeable to profits tax on the rental

profits which is sourced from immovable properties in Hong Kong.

The double taxation of the special purpose company, which is subject to both property tax and profits tax by definition,

can be eliminated by the application of s.5(2)(a). Under this section, any corporation which is subject to profits tax in

respect of rental profits can apply for an exemption from property tax in relation to the same rental profits. In the case

of the special purpose company, it will be advisable for it to claim exemption under s.5(2)(a) so that the rental profits

are only subject to profits tax under s.14. Any property tax paid can be offset against profits tax chargeable on the

company for the same rent receivable under s.25, any excess thereof will be refunded.

Profits tax under s.14 is imposed on assessable profits which take into account all relevant expenses and outgoings that

are incurred in the production of those assessable profits (s.16). It is therefore possible to deduct related expenses such

as mortgage interest, management fees and repairs. Depreciation allowances will be calculated on the renovation costs

as well as the qualifying costs of construction of the property (if the property is not a trading stock) and deductible against

the rental profits. In a situation where total deductible expenditure exceeds total rental revenue, the excess loss can be

carried forward to subsequent years and is eligible for deduction against any future taxable profits. In Mr Chan’s case,

this will possibly be the case since the monthly rent is expected to be insufficient to cover the mortgage interest.

Currently, the profits tax rate applicable is 165%.

As compared to (i) above, although the applicable tax rate for a company (165%) would be higher than that applicable

for an individual (15%), the company’s taxable profits should be lower, possibly even reduced to zero, as more

expenditure is allowable and no limitation is imposed for the tax-deductible mortgage interest incurred.

(c) Effectiveness of the tax planning ideas

One of Mr Chan’s ideas is to hold the property in the name of his daughter, who has always lived in the UK and has no

connection with Hong Kong. It is Mr Chan’s belief that this would render the rental income to be tax-free for Hong Kong tax

purposes. As mentioned in (b)(i) above, property tax is imposed on any owner of land or building (or land and building)

situated in Hong Kong. As long as the land or building (or land and building) is situated in Hong Kong, property tax is payable

on any rental income received for the right to use. The citizenship, residence or place of domicile of the owner is irrelevant.

Another idea is to hold the property in the name of a company incorporated in an offshore tax haven with a view to avoiding

tax in Hong Kong. Under the property tax regime, as explained above, the rental income received from properties located in

Hong Kong will be taxable regardless of the citizenship, residence or place of domicile of the owner. This is also applicable

in the case of a corporate owner. Therefore, if rental income is received by an offshore tax haven company which is the

registered owner of a property located in Hong Kong, property tax is still payable by the company.

As far as profits tax is concerned, however, whether or not the tax haven company is taxable under s.14 depends on whether

or not the company carries on its property letting business in Hong Kong. The issue of ‘carrying on business’ is a matter of

fact but is usually contentious. Simply setting up the company offshore may not necessarily be sufficient to prove that the

company does not carry on a business in Hong Kong. By having a property located in Hong Kong and let for rent, it will be

regarded as carrying on business in Hong Kong and thus subject to profits tax under s.14(1), since the rental income must

have a source in Hong Kong.

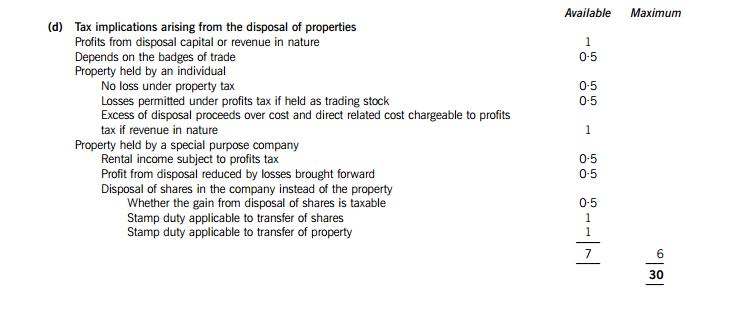

(d) Tax implications arising from the disposal of properties

In the event of the disposal of the properties, any profits arising from the disposal will be subject to profits tax in Hong Kong

if they are considered revenue in nature. Profits which are capital in nature are not taxable in Hong Kong. Whether the profits

are capital or revenue will be decided by applying the principles commonly known as the badges of trade, which look at

various parameters of facts, including the nature of the subject matter itself, the intention at the time of acquisition,

19circumstances leading to the disposal, length of ownership, frequency of transaction, profit-motive, any additional work done

to the property before sale, and method of financing, etc. These factors are relevant regardless of whether the properties are

held by an individual or a company.

If the properties are held by an individual as a trading stock, i.e. for trading, property tax and profits tax are both chargeable

during the period in which rental income is received, subject to offsetting under s.25 (as in (b) above). A loss is allowed under

profits tax but not property tax. In the event of disposal, profits tax will be calculated based on the excess of the disposal

proceeds over the original cost of the properties. Direct related costs such as legal fees may be deducted.

If the properties are held by a company, upon exemption from property tax under s.5(2)(a), profits tax is paid during the period

when the ownership remains with the company. As stated above, it is possible to incur a loss if the total expenditure such as

mortgage interest and depreciation allowance is in excess of the rental income received and such a loss incurred can be

carried forward by the company for offset against future profits. In the year of disposal when taxable revenue profits are

derived, the profits will be reduced by the accumulated tax loss brought forward. It is therefore possible that the taxable profits

from the disposal will be reduced.

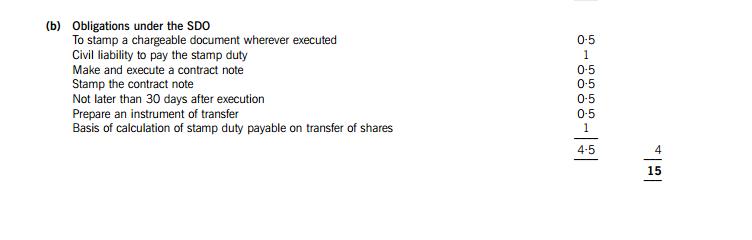

Where commercially feasible, it is also possible to dispose of the shares in the special purpose company instead of the

property itself. Whether the gain arising from the disposal of shares is taxable or not again depends on the badges of trade

as mentioned above. However, the main difference here is the different rate of stamp duty applicable to a transfer of shares

as opposed to a transfer of property. For a transfer of shares, the contract notes (both bought and sold notes) will be liable to

stamp duty under Head 2 of the Stamp Duty Ordinance (SDO) at the rate of 02% on the consideration or the value of shares

bought and sold. For a transfer of property, the agreement for sale and purchase of the property will be liable to ad valorem

duty under Head 1(1A) of the SDO at the rate of 15% to 425% on the greater of the consideration or the unencumbered

value of the property. The formal assignment executed in conformity with the stamped agreement will only be liable to duty

at the fixed rate of $100.

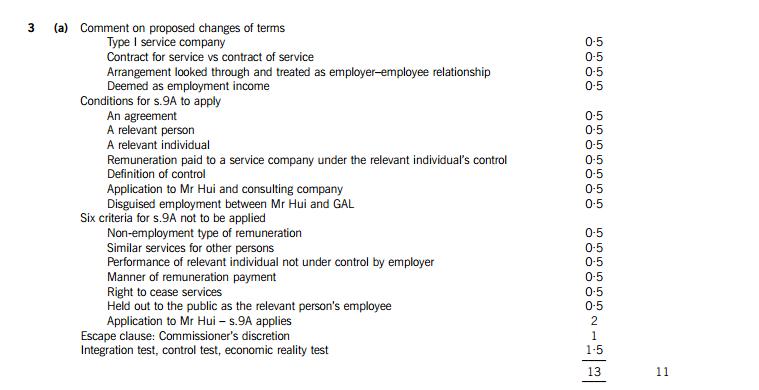

3 Mr Hui and GA Ltd

(a) Based on the proposed changes of appointment terms given, it is likely that the consulting company established by Mr Hui

would be regarded by the IRD as a Type I service company and the provisions of s.9A would be applied to determine whether

the new appointment constitutes a contract for service (i.e. an independent contractor), or a contract of service (i.e. an

employment). If s.9A applies, the arrangement would be ‘looked through’ such that the relationship between GA Ltd (GAL)

and Mr Hui would continue to be treated as an employeremployee relationship. Any payment made to the consulting

company would be deemed as employment income of Mr Hui who provided the employment services to GAL in return for

the income.

For s.9A to successfully apply, the following conditions must be satisfied:

(i) There is an agreement in this case, the service agreement between GAL and the consulting company will be the

relevant agreement.

(ii) There is a ‘relevant person’ in this case, GAL is the relevant person who carries on business in Hong Kong and who

has entered into an agreement for the provision of services by Mr Hui in return for a payment.

(iii) There is a ‘relevant individual’ in this case, Mr Hui is the relevant individual who provides services to the relevant

person as required by the relevant agreement.

(iv) The remuneration for the relevant individual’s services is paid to a service company which is under the control of the

relevant individual in this case, the remuneration for Mr Hui’s services is to be paid to the consulting company, which

is presumably wholly owned and controlled by Mr Hui. Control is defined under s.9A to mean the power of a person to

secure that the affairs of the company are conducted in accordance with the wishes of that person either through the

holding of shares or relevant voting power. In this case, although the question has not clearly stated the power of

Mr Hui, the fact that Mr Hui is required to establish the consulting company and ensure that the company enters into

the proposed arrangement with GAL would be sufficient to demonstrate the power or control by Mr Hui over the

consulting company.

If the above conditions are satisfied, the arrangement is regarded as a ‘disguised employment’ between Mr Hui and GAL.

However, s.9A can have no application to deem such an employeremployee relationship if ALL of the following criteria are

satisfied in relation to the appointment terms:

(1) Neither the agreement in question nor any related undertaking provides for remuneration to include annual leave,

passage allowance, sick leave, pension entitlements, medical payments, accommodation or any similar benefit, or any

benefit (including money) in lieu thereof in Mr Hui’s case, the service agreement not only specifies the monthly

remuneration but also the annual profit-sharing bonus as well as the maximum number of days of annual vacation.

(2) If the agreement, or a related undertaking, requires any of the services to be carried out personally by the relevant

individual, that the relevant individual also carries out similar services for persons other than the relevant person during

the term of the agreement in this case, Mr Hui is the designated individual to provide services to GAL but it is silent

as to whether Mr Hui is allowed to provide similar services to other parties.

20(3) The performance of any of the services by the relevant individual is not subject to any control or supervision commonly

exercised by an employer in this case, Mr Hui will continue to be under the instruction and supervision of his current

boss, GAL’s Group IT director.

(4) The remuneration is not paid or credited periodically or calculated on a basis commonly used in employment contracts

the payment in this case will be made by GAL directly into the consulting company’s bank account on a monthly basis.

(5) The relevant person does not have the right to order the cessation of services in a manner or for reasons which are

commonly provided for in a contract of employment the question does not provide details as to whether GAL has the

right to terminate Mr Hui’s services as if it is his employer.

(6) The relevant individual is not held out to the public to be an officer or employee of the relevant person Mr Hui is

requested to continue with his current title of Regional IT manager, and thus it is obviously expected that he will be

presumed by others to be GAL’s employee.

As shown above, Mr Hui’s case satisfies some but not all of the above criteria.

In the circumstances, it is likely that s.9A would apply. Nonetheless, s.9A(4) also provides an ‘escape clause’ for the benefit

of taxpayers. It is provided that the Commissioner of Inland Revenue (CIR) has a wide discretionary power to exclude a case

from being deemed as an employment, if he is satisfied that in substance an individual is not holding an office or employment.

In considering cases under this escape clause, the CIR will usually look at the case law distinguishing between a contract of

service (i.e. an employment) and a contract for service (i.e. an independent contractor). Although there is no single decisive

test that can be used for all cases (Hall v Lorimer), there are factors which are commonly used by the courts to establish the

existence of an employment. These factors are generally known as the integration test, control test and economic reality test.

Briefly speaking, the integration test examines whether the service provider is part of the organisation and held out to the

public as an officer of that organisation. The control test examines whether the person demanding the service has control over

how and when the services are performed. The economic reality test examines whether the service provider performs the

services on his own account and bears his own business risk.

In the case of Mr Hui, it is fairly obvious that the proposed arrangement would be likely to fail all these tests. In conclusion,

it is highly likely that the proposed arrangement would be regarded as a disguised employment and thus Mr Hui would

continue to be treated as the employee of GAL.

Tutorial note: An arrangement which falls outside the scope of s.9A may nevertheless be charged to salaries tax by the IRD

through the application of the general anti-avoidance provisions in s.61 and s.61A.

(b) Where s.9A operates to ‘look through’ the arrangement and deem Mr Hui as the employee of GAL, the whole amount paid

by GAL to the consulting company would be regarded as the employment income of Mr Hui. This whole payment would

continue to be subject to salaries tax in the name of Mr Hui as is the case prior to 1 September 2012. If Mr Hui has entered

into an employment contract with the consulting company and receives remuneration under that contract, such remuneration

will be exempt from salaries tax in order to avoid Mr Hui being doubly taxed on the same income.

In the case of the consulting company, since the arrangement has been ‘looked through’, the income received by the

consulting company from GAL would not be subject to profits tax. This is to avoid double taxation because such ‘income’ has

been deemed as employment income received by Mr Hui and brought into the salaries tax net. In addition, the remuneration

paid by the consulting company to Mr Hui under the new employment contract would not be allowed as a tax deduction.

In the case of GAL, it will be regarded as the employer of Mr Hui regardless of the proposed arrangement and irrespective of

what clauses have been explicitly included in the service agreement. As an employer, GAL will be obliged to comply with the

necessary reporting obligations of an employer such as annual employer’s return for reporting remuneration, notification of

commencement and cessation of employment, and notification of leaving Hong Kong and retention of money. Failure to

comply with the reporting obligations would render GAL liable to penalties.

4 Compass Ltd and David Lo partnership

The additional information needed to determine the profits tax payable by the partnership business is as follows:

(1) Cost of sales The basis of stock valuation and whether any goods were taken for private use by the partners.

(2) Interest income A breakdown of the interest income to check whether the interest is on trade debts (which is taxable), or

from a loan provided in Hong Kong (which is onshore) or outside Hong Kong (which is offshore), or from a deposit placed

with a bank in Hong Kong (which is sourced in Hong Kong), or outside Hong Kong (which is offshore); and whether the

deposit is pledged as a security for any bank overdraft facilities or bank loans.

Interest accrued on deposits with financial institutions in Hong Kong is exempt from profits tax under the Exemption from

Profits Tax (Interest Income) Order 1998. However, the exemption does not apply to interest on a deposit which is used to

secure or guarantee money borrowed from a financial institution, if the borrowing fulfils s.16(1)(a), any of the conditions in

s.16(2)(c), (d) or (e) is satisfied, and s.16(2A) does not apply.

21(3) Compensation for cancellation of a sales contract Whether the compensation received for the cancellation of the sales

contract is a capital or a revenue item. In general terms:

(a) Compensation is revenue in nature and taxable if the compensation is made to cover the revenue loss suffered from the

cancellation of a sales contract. Since income from the contract is taxable revenue income, compensation made to cover

the loss of such income is accordingly revenue in nature and taxable.

(b) Compensation for the cancellation of a sales contract which constitutes the whole business of the company leading to

the closing down of the company’s business will be regarded as capital in nature and non-taxable.

(4) Salaries The amount, if any, of any salaries paid to the partner (Mr Lo) and his spouse. Any such amount is not deductible:

s.17(2).

(5) Contributions to mandatory provident fund scheme (MPFS) A breakdown of the contributions to check whether they are tax

deductible. The tax treatment for contributions made to MPFS are as follows:

(a) Regular contributions to MPFS are deductible, but limited to 15% of each employee’s remuneration: ss.16(1) and

17(1)(h).

(b) Contributions other than regular contributions to MPFS are deductible over five years in equal annual instalments,

commencing from the year the contributions are made: s.16A.

(c) A provision for regular contributions (mandatory or voluntary) to MPFS is deductible, but limited to 15% of each

employee’s remuneration: ss.16(1) and 17(1)(i).

(d) Contributions to MPFS where a provision has previously been allowed as a deduction are not deductible: s.17(1)(k).

(e) Mandatory contributions to MPFS made by a self-employed person (Mr Lo as the partner) are deductible, if not otherwise

allowable and not exceeding $12,000: s.16AA.

(6) Repairs and alterations A breakdown of the amount to check whether any capital expenditure, such as that on improvement,

was included. If any expenditure is of a capital nature, it is necessary to ascertain whether it qualifies for depreciation

allowances or is otherwise deductible as refurbishment and renovation expenses on a straight-line basis over five years under

s.16F.

(7) Interest expenses A breakdown to check whether the general and specific provisions of s.16(1)(a) and s.16(2) are satisfied.

Interest payable to a bank is tax deductible if the following conditions are fulfilled:

(a) the bank interest is incurred in the production of assessable profits: s.16(1);

(b) the bank borrowing is not secured by any deposits or loans which derive non-taxable income in Hong Kong (the ‘secured

loan test’): s.16(2A); and

(c) there is no arrangement in place such that the interest payment is ultimately paid back to the borrower or any connected

person (the ‘interest flow-back test’): s.16(2B).

Any amount of interest paid to the partner (Mr Lo) and his spouse is not deductible: s.17(2).

(8) Rent and rates The proportion, if any, of any rent and rates, representing private as opposed to trading expenses, and the

basis upon which the proportion is calculated. Any private portion must be disallowed: s.17(2).

(9) Legal and professional fees and sundry expenses A breakdown to check whether any capital or private items are included.

Expenses of a revenue nature incurred in the course of business would normally be allowed. Any capital and private items

must be disallowed, particularly in the case of the purchase of non-current assets. However, legal fees in connection with the

borrowing of money used for the purpose of producing chargeable profits are specifically allowed under s.16(1)(a).

(10) Research and development Ensure that:

(i) the expenditure is incurred on any activities in the fields of natural or applied science for the extension of knowledge;

and any systematic, investigative or experimental activities in respect of any feasibility study, or any market, business or

management research;

(ii) the scientific research is related to the partnership’s trade or class of trade; and

(iii) any capital expenditure on machinery and plant which is required for scientific research is deductible in full, but no

deduction is allowed for capital expenditure on land or buildings (depreciation allowance may be granted).

(11) Patent expenses Ensure that the amount claimed represents a payment to purchase patent rights specifically deductible

under s.16E. To be deductible, the patent must not be purchased from an associate.

(12) Property tax This expense has been charged as paid but no rent has been included in the accounts. This should be clarified.

(13) Dividends A nominal adjustment may also be made in the tax computation under IRR 2C to reflect the expenses incurred

to produce non-taxable income. In other words, an amount of overhead expenditure relating to the investment portfolio should

be added back in the tax computation.

(14) Ascertain the ratio in which the partners share the profit or loss. Allocation of profits among the partners is necessary as the

corporate partner’s share of profits is taxed at the corporate rate of 165%.

(15) Ascertain if there is any loss brought forward for set-off against this year’s profit, and whether the partner, David Lo, will elect

for personal assessment for 2011/12.

(16) Movements of non-current assets for computing the depreciation allowance. It is necessary to ascertain whether new

additions qualify for depreciation allowances or are otherwise deductible in full as prescribed fixed assets under s.16G.

相关推荐:

ACCA教材辅导讲义——Pilotpapers for F3

更多ACCA考试信息请关注读书人网(http://www.reader8.net/)

ACCA频道(http://www.reader8.net/exam/acca/)