ALL FIVE questions are compulsory and MUST be attempted

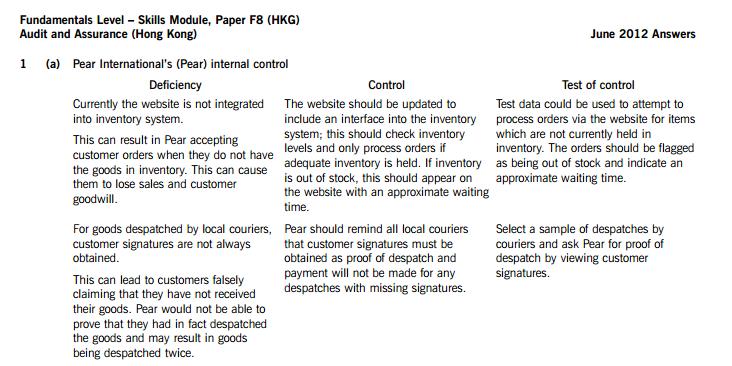

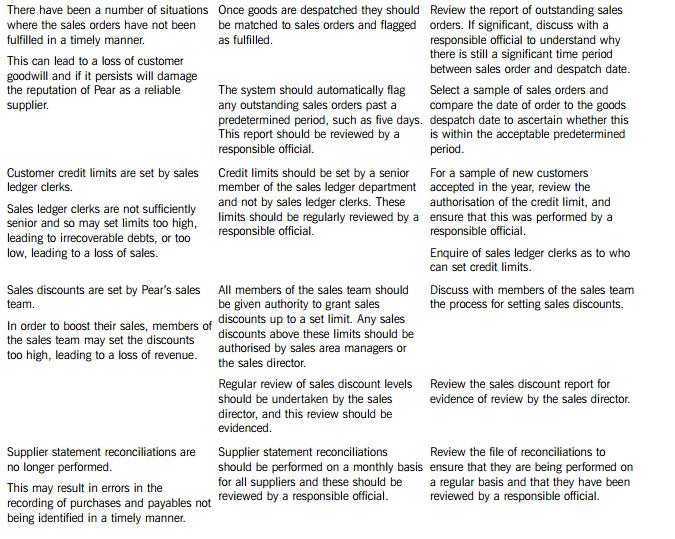

1 Pear International Co (Pear) is a manufacturer of electrical equipment. It has factories across the country and its

customer base includes retailers as well as individuals, to whom direct sales are made through their website. The

company’s year end is 30 September 2012. You are an audit supervisor of Apple & Co and are currently reviewing

documentation of Pear’s internal control in preparation for the interim audit.

Pear’s website allows individuals to order goods directly, and full payment is taken in advance. Currently the website

is not integrated into the inventory system and inventory levels are not checked at the time when orders are placed.

Goods are despatched via local couriers; however, they do not always record customer signatures as proof that the

customer has received the goods. Over the past 12 months there have been customer complaints about the delay

between sales orders and receipt of goods. Pear has investigated these and found that, in each case, the sales order

had been entered into the sales system correctly but was not forwarded to the despatch department for fulfilling.

Pear’s retail customers undergo credit checks prior to being accepted and credit limits are set accordingly by sales

ledger clerks. These customers place their orders through one of the sales team, who decides on sales discount levels.

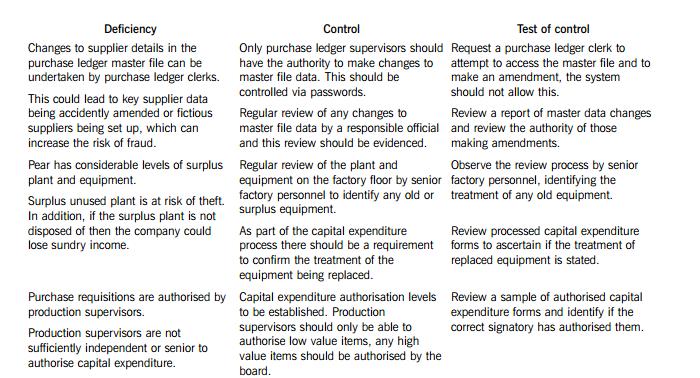

Raw materials used in the manufacturing process are purchased from a wide range of suppliers. As a result of staff

changes in the purchase ledger department, supplier statement reconciliations are no longer performed. Additionally,

changes to supplier details in the purchase ledger master file can be undertaken by purchase ledger clerks as well as

supervisors.

In the past six months Pear has changed part of its manufacturing process and as a result some new equipment has

been purchased, however, there are considerable levels of plant and equipment which are now surplus to

requirement. Purchase requisitions for all new equipment have been authorised by production supervisors and little

has been done to reduce the surplus of old equipment.

Required:

(a) In respect of the internal control of Pear International Co:

(i) Identify and explain FIVE deficiencies;

(ii) Recommend a control to address each of these deficiencies; and

(iii) Describe a test of control Apple & Co would perform to assess if each of these controls is operating

effectively. (15 marks)

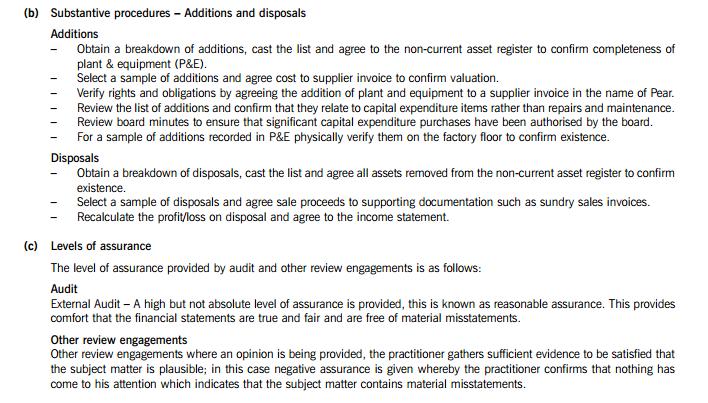

(b) Describe substantive procedures you should perform at the year end to confirm each of the following for plant

and equipment:

(i) Additions; and

(ii) Disposals. (4 marks)

(c) Pear’s finance director has expressed an interest in Apple & Co performing other review engagements in addition

to the external audit; however, he is unsure how much assurance would be gained via these engagements and

how this differs to the assurance provided by an external audit.

Required:

Identify and explain the level of assurance provided by an external audit and other review engagements.

(3 marks)

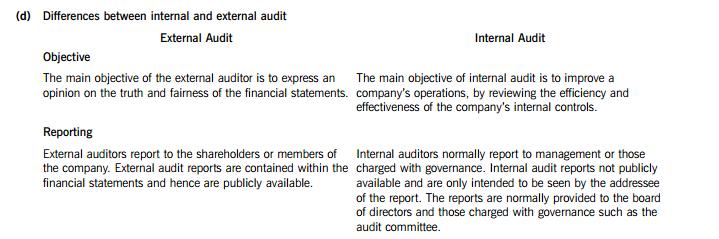

2Pear’s directors are considering establishing an internal audit department next year, and the finance director has asked

about the differences between internal audit and external audit and what impact, if any, establishing an internal audit

department would have on future external audits performed by Apple & Co.

Required:

(d) Distinguish between internal audit and external audit. (4 marks)

(e) Explain the potential impact on the work performed by Apple & Co during the interim and final audits, if Pear

International Co was to establish an internal audit department. (4 marks)

(30 marks)

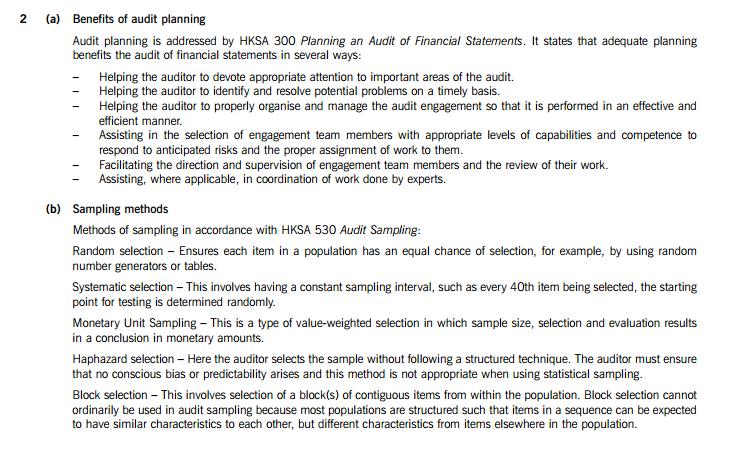

3 [P.T.O.2 (a) HKSA 300 Planning an Audit of Financial Statements provides guidance to assist auditors in planning an audit.

Required:

Explain the benefits of audit planning. (4 marks)

(b) HKSA 530 Audit Sampling provides guidance on methods for selecting a sample of items for testing.

Required:

Identify and explain THREE methods of selecting a sample. (3 marks)

(c) Describe the three types of modified audit opinions. (3 marks)

(10 marks)

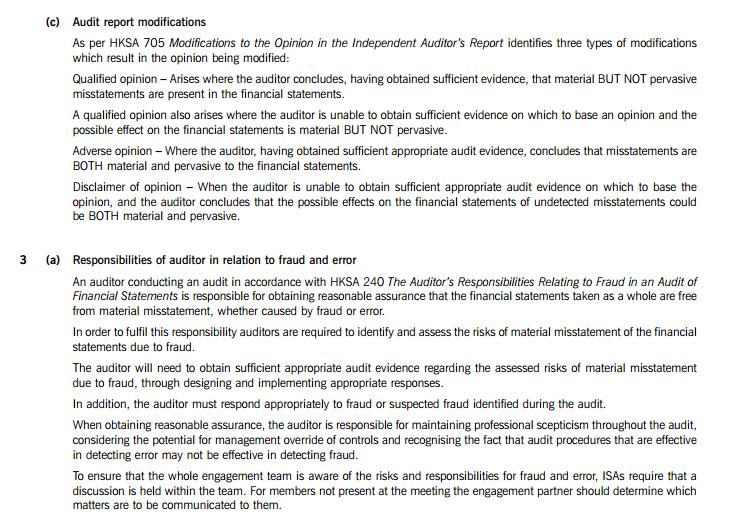

3 (a) Explain the external auditors’ responsibilities in relation to the prevention and detection of fraud and error.

(4 marks)

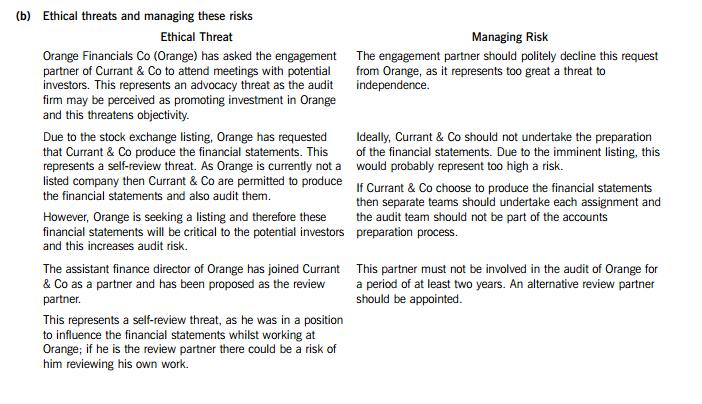

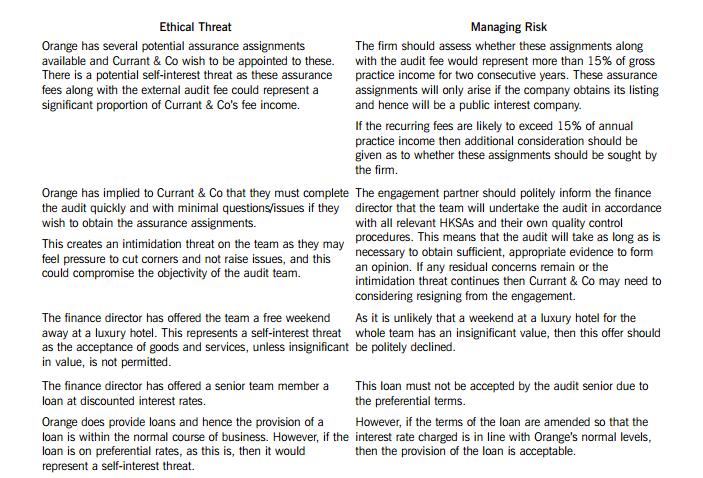

You are the audit manager of Currant & Co and you are planning the audit of Orange Financials Co (Orange), who

specialise in the provision of loans and financial advice to individuals and companies. Currant & Co has audited

Orange for many years.

The directors are planning to list Orange on a stock exchange within the next few months and have asked if the

engagement partner can attend the meetings with potential investors. In addition, as the finance director of Orange is

likely to be quite busy with the listing, he has asked if Currant & Co can produce the financial statements for the

current year.

During the year, the assistant finance director of Orange left and joined Currant & Co as a partner. It has been

suggested that due to his familiarity with Orange, he should be appointed to provide an independent partner review

for the audit.

Once Orange obtains its stock exchange listing it will require several assignments to be undertaken, for example,

obtaining advice about corporate governance best practice. Currant & Co is very keen to be appointed to these

engagements, however, Orange has implied that in order to gain this work Currant & Co needs to complete the external

audit quickly and with minimal questions/issues.

The finance director has informed you that once the stock exchange listing has been completed, he would like the

engagement team to attend a weekend away at a luxury hotel with his team, as a thank you for all their hard work.

In addition, he has offered a senior member of the engagement team a short-term loan at a significantly reduced

interest rate.

Required:

(b) (i) Explain SIX ethical threats which may affect the independence of Currant & Co’s audit of Orange

Financials Co; and

(ii) For each threat explain how it might be reduced to an acceptable level. (12 marks)

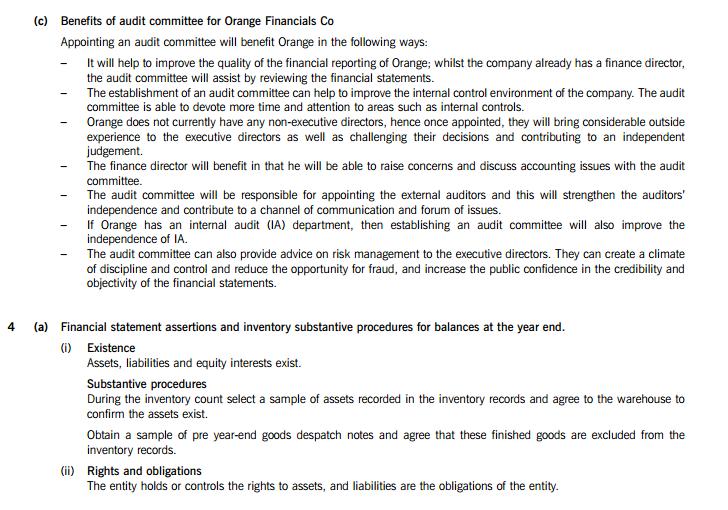

(c) Orange is aware that subsequent to the stock exchange listing it will need to establish an audit committee and

has asked for some advice in relation to this.

Required:

Explain the benefits to Orange of establishing an audit committee. (4 marks)

(20 marks)

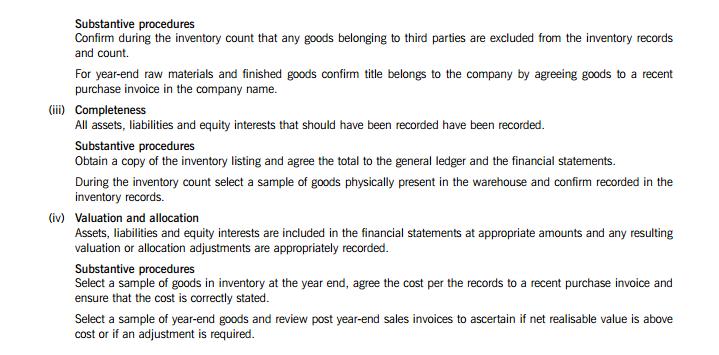

44 (a) (i) Identify and explain FOUR financial statement assertions relevant to account balances at the year end;

and

(ii) For each identified assertion, describe a substantive procedure relevant to the audit of year-end

inventory. (8 marks)

(b) Pineapple Beach Hotel Co (Pineapple) operates a hotel providing accommodation, leisure facilities and

restaurants. Its year end was 30 April 2012. You are the audit senior of Berry & Co and are currently preparing

the audit programmes for the year end audit of Pineapple. You are reviewing the notes of last week’s meeting

between the audit manager and finance director where two material issues were discussed.

Depreciation

Pineapple incurred significant capital expenditure during the year on updating the leisure facilities for the hotel.

The finance director has proposed that the new leisure equipment should be depreciated over 10 years using the

straight-line method.

Food poisoning

Pineapple’s directors received correspondence in March from a group of customers who attended a wedding at

the hotel. They have alleged that they suffered severe food poisoning from food eaten at the hotel and are

claiming substantial damages. Pineapple’s lawyers have received the claim and believe that the lawsuit against

the company is unlikely to be successful.

Required:

Describe substantive procedures to obtain sufficient and appropriate audit evidence in relation to the above

two issues.

Note: The total marks will be split equally between each issue. (8 marks)

(c) List and explain the purpose of FOUR items that should be included on every working paper prepared by the

audit team. (4 marks)

(20 marks)

5 [P.T.O.5 (a) Explain the three stages of an audit when analytical procedures can be used by the auditor. (3 marks)

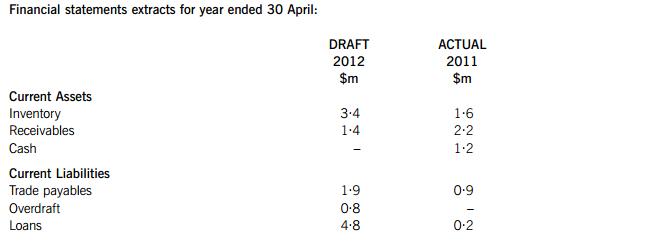

You are the audit manager of Kiwi & Co and you have been provided with financial statements extracts and the

following information about your client, Strawberry Kitchen Designs Co (Strawberry), who is a kitchen manufacturer.

The company’s year end is 30 April 2012.

Strawberry has recently been experiencing trading difficulties, as its major customer who owes $06m to Strawberry

has ceased trading, and it is unlikely any of this will be received. However, the balance is included within the financial

statements extracts below. The sales director has recently left Strawberry and has yet to be replaced.

The monthly cash flow has shown a net cash outflow for the last two months of the financial year and is forecast as

negative for the forthcoming financial year. As a result of this, the company has been slow in paying its suppliers and

some are threatening legal action to recover the sums owing.

Due to its financial difficulties, Strawberry missed a loan repayment and, as a result of this breach in the loan

covenants, the bank has asked that the loan of $48m be repaid in full within six months. The directors have decided

that in order to conserve cash, no final dividend will be paid in 2012.

Required:

(b) Explain the potential indicators that Strawberry Kitchen Designs Co is not a going concern. (6 marks)

(c) Describe the audit procedures that you should perform in assessing whether or not the company is a going

concern. (6 marks)

(d) Having performed the going concern audit procedures, you have serious concerns in relation to the going concern

status of Strawberry. The finance director has informed you that as the cash flow issues are short term he does

not propose to make any amendments to the financial statements.

Required:

(i) State Kiwi & Co’s responsibility for reporting on going concern to the directors of Strawberry Kitchen

Designs Co; and (2 marks)

(ii) If the directors refuse to amend the financial statements, describe the impact on the audit report.

(3 marks)

(20 marks)

End of Question Paper

相关推荐:

ACCA教材辅导讲义——Pilotpapers for F3

更多ACCA考试信息请关注读书人网(http://www.reader8.net/)

ACCA频道(http://www.reader8.net/exam/acca/)