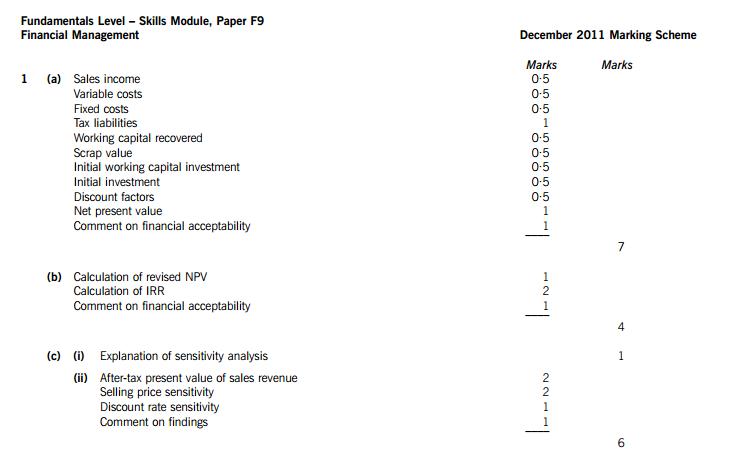

Since the internal rate of return of the investment (16%) is greater than the cost of capital of Warden Co, the investment is

financially acceptable.

Examiner’s note: although the value of the calculated IRR will depend on the two discount rates used in linear interpolation,

other discount rate choices should produce values close to 16%.

(c) Sensitivity analysis indicates which project variable is the key or critical variable, i.e. the variable where the smallest relative

change makes the net present value (NPV) zero. Sensitivity analysis can show where management should focus attention in

order to make an investment project successful, or where underlying assumptions should be checked for robustness.

The sensitivity of an investment project to a change in a given project variable can be calculated as the ratio of the NPV to

the present value (PV) of the project variable. This gives directly the relative change in the variable needed to make the NPV

of the project zero.

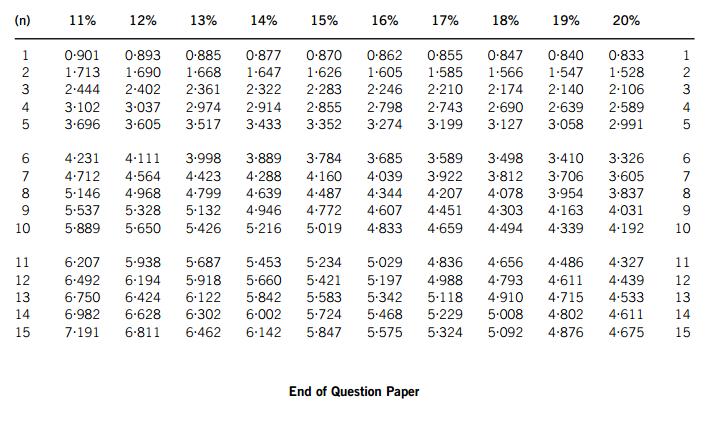

Selling price sensitivity

The PV of sales revenue = 100,000 x 16 x 3696 = $5,913,600

The tax liability associated with sales revenue needs be considered, as the NPV is on an after-tax basis.

Tax liability arising from sales revenue = 100,000 x 16 x 03 = $480,000 per year

The PV of the tax liability without lagging = 480,000 x 3696 = $1,774,080

(Alternatively, PV of tax liability without lagging = 5,913,600 x 03 = $1,774,080)

Lagging by one year, PV of tax liability = 1,774,080 x 0901 = $1,598,446

After-tax PV of sales revenue = 5,913,600 1,598,446 = $4,315,154

Sensitivity = 100 x 103,000/4,315,154 = 24%

Discount rate sensitivity

Increase in discount rate needed to make NPV zero = 16 11 = 5%

Relative change in discount rate needed to make NPV zero = 100 x 5/11 = 45%

Of the two variables, the key or critical variable is selling price, since the investment is more sensitive to a change in this

variable (24%) than it is to a change in discount rate (45%).

(d) In real-world capital investment decisions, companies are limited in the funds that are available for investment. However, the

basis for investment decisions should still be to maximise the wealth of shareholders. The NPV decision rule calls for a

company to invest in all projects with a positive net present value, but this is theoretically possible only in a perfect capital

market, i.e. a capital market where there is no limit on the finance available. Since investment funds are limited in the real

world, it is not possible in the real world for a company to invest in all projects with a positive NPV.

The reasons why investment funds are limited in the real world are either external to the company (hard capital rationing) or

internal to the company (soft capital rationing).

Several reasons have been suggested for hard capital rationing, such as that investors may feel that a company is too risky

to invest in, with its credit rating being seen as too low for the amount of investment it needs. Perhaps capital markets may

be depressed, so that there is a general unwillingness by investors to provide funds for capital investment. Capital may be in

short supply due to ‘crowding-out’ as a result of high government borrowing, for example in order to finance a Keynsian

injection of funds into the circular flow of income so as to encourage or assist recovery from an economic recession.

Soft capital rationing may be due to reluctance by a company to raise finance. For example, the amount of funds needed may

be small in relation to the costs of raising the finance: or the company may wish to avoid dilution of control or earnings per

share by issuing new equity; or the company may wish to avoid a commitment to paying fixed interest because it believes

future economic conditions may put its profitability under pressure. Alternatively, the company may limit the funds available

for capital investment in order to encourage competition between potential investment projects, so that only robust investment

projects are accepted. This is the ‘internal capital market’ reason for soft capital rationing.

If a company cannot invest in all projects with a positive NPV, it must ensure that it generates the maximum return per dollar

invested. With single-period capital rationing, where investment funds are limited in the first year only, divisible investment

projects can be ranked in order of desirability using the profitability index. This can be defined either as the NPV divided by

the initial investment, or as the present value of future cash flows divided by the initial investment. The optimal investment

decision for a company is then to invest in the projects in turn, moving from highest profitability index downwards, until all

the funds have been exhausted. This may require partial investment in the last desirable project selected, which is possible

with divisible investment projects.

Where investment projects are not divisible, the total NPV of various combinations of projects must be compared, within the

limit of the investment funds available, in order to select the combination of projects with the highest NPV. This will be the

optimum investment decision. Surplus funds may be left over, but since the highest-NPV combination has been selected, the

amount of surplus funds is irrelevant to the selection of the optimal investment schedule. Investing these surplus funds in a

bank or in the money market would have an NPV of zero.

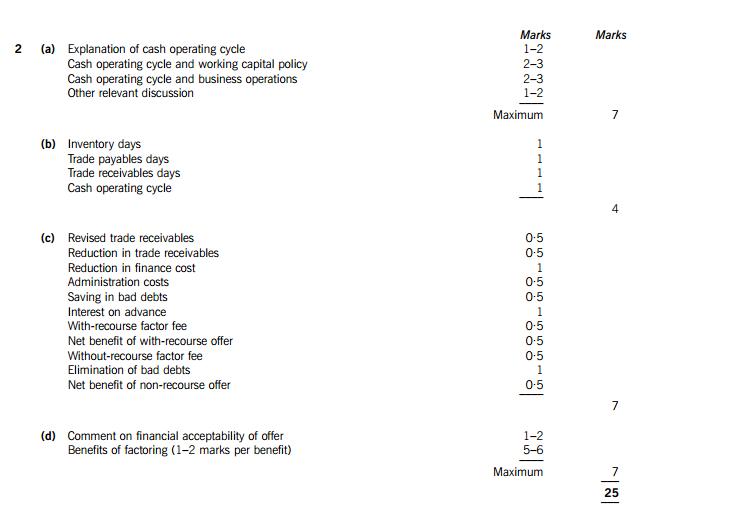

122 (a) The cash operating cycle is the average length of time between paying trade payables and receiving cash from trade

receivables. It is the sum of the average inventory holding period, the average production period and the average trade

receivables credit period, less the average trade payables credit period. Using working capital ratios, the cash operating cycle

is the sum of the inventory turnover period and the accounts receivable days, less the accounts payable days.

The relationship between the cash operating cycle and the level of investment in working capital is that an increase in the

length of the cash operating cycle will increase the level of investment in working capital. The length of the cash operating

cycle depends on working capital policy in relation to the level of investment in working capital, and on the nature of the

business operations of a company.

Working capital policy

Companies with the same business operations may have different levels of investment in working capital as a result of

adopting different working capital policies. An aggressive policy uses lower levels of inventory and trade receivables than a

conservative policy, and so will lead to a shorter cash operating cycle. A conservative policy on the level of investment in

working capital, in contrast, with higher levels of inventory and trade receivables, will lead to a longer cash operating cycle.

The higher cost of the longer cash operating cycle will lead to a decrease in profitability while also decreasing risk, for example

the risk of running out of inventory.

Nature of business operations

Companies with different business operations will have different cash operating cycles. There may be little need for inventory,

for example, in a company supplying business services, while a company selling consumer goods may have very high levels

of inventory. Some companies may operate primarily with cash sales, especially if they sell direct to the consumer, while other

companies may have substantial levels of trade receivables as a result of offering trade credit to other companies.

(d) The factor’s offer is financially acceptable on a with-recourse basis, giving a net benefit of $13,497. On a non-recourse basis,

the factor’s offer is not financially acceptable, giving a net loss of $93,003, if the elimination of bad debts is ignored. The

difference between the two factor fees ($106,500 or 05% of sales), which represents insurance against the risk of bad debts,

is less than the remaining bad debts ($127,800 or 06% of sales), which will be eliminated under non-recourse factoring.

When this elimination of bad debts is considered, the non-recourse offer from the factor is financially more attractive than the

with-recourse offer.

13There are a number of benefits of factoring that could be discussed, as follows.

The expertise of the factor

It is possible the factor can improve the efficiency of the receivables management of Bold Co due to its expertise in the areas

of credit analysis, credit control and receivables collection. This would lead to a lower level of bad debts, as indicated by the

factor’s offer.

Insurance against bad debts

Non-recourse factoring offers protection from bad debts, although the factor’s fee will include the cost of this insurance

element, as indicated by the difference between the factor’s fees.

Factor finance

A factor will advance up to 80% of the value of invoices raised, allowing a company quicker access to cash from sales than

would be possible if it had to wait for accounts receivable to be settled. Bold Co could pay trade payables promptly, perhaps

benefiting from early settlement discounts.

Lower administration costs

Since administration of trade receivables would be taken over by the factor, administration costs of the company would

decrease over time, although some incremental short-term costs, such as redundancy costs, might be incurred.

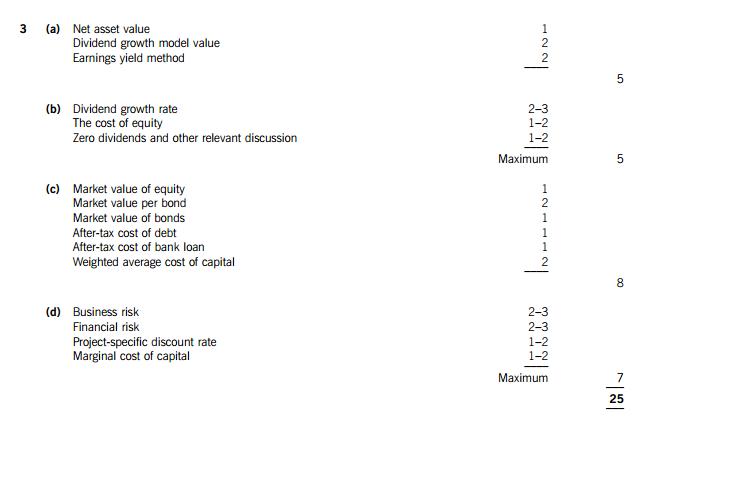

3 (a) Net asset valuation

In the absence of any information about realisable values and replacement costs, net asset value is on a book value basis. It

is the sum of non-current assets and net current assets, less long-term debt, i.e. 595 + 125 70 160 = $490 million.

Dividend growth model

Total dividends of $40 million are expected to grow at 4% per year and Close Co has a cost of equity of 10%.

Value of company = (40m x 104)/(01 004) = $693 million

Earnings yield method

Profit after tax (earnings) is $666 million and the finance director of Close Co thinks that an earnings yield of 11% per year

can be used for valuation purposes.

Ignoring growth, value of company = 666m/011 = $606 million

Alternatively, profit after tax (earnings) is expected to grow at an annual rate of 5% per year and earnings growth can be

incorporated into the earnings yield method using the growth model.

Value of company = (666m x 105)/(011 005) = $1,166 million

Examiner’s note: full credit would be gained whether or not growth is incorporated in the earnings yield method.

(b) The dividend growth model (DGM) is used widely in valuing ordinary shares and hence in valuing companies, but there are

a number of weaknesses associated with its use.

The future dividend growth rate

The DGM is based on the assumption that the future dividend growth rate is constant, but experience shows that a constant

dividend growth rate is, in reality, very rare. This may be seen as less of a problem if the future dividend growth rate is

regarded as an average growth rate.

Estimating the future dividend growth rate is very difficult in practice and the DGM is very sensitive to small changes in this

key variable. It is common practice to estimate the future dividend growth rate by calculating the historical dividend growth,

but the assumption that the future will reflect the past is an easy one to challenge.

The cost of equity

The DGM assumes that the future cost of equity is constant, when in reality it changes quite frequently. The cost of equity

can be calculated using the capital asset pricing model, but this model usually employs historical information, which may not

reflect accurately expectations about the future.

Zero dividends

It is sometimes claimed that the DGM cannot be used when no dividends are paid, but this depends on whether dividends

are expected in the future. If dividends are forecast to be paid from a future date, the dividend growth model can be applied

at that point to calculate a share price, which can then be discounted to give the current ex dividend share price. Only in the

case where no dividends are paid and no dividends are expected to be paid will the DGM have no application.

(c) Market value of equity

Close Co has 80 million shares in issue and each share is worth $850 per share.

The market value of equity is therefore 80 x 850 = $680 million

Cost of equity

This is given as 10% per year.

Market value of 8% bonds

The market value of each bond will be the present value of the expected future cash flows (interest and principal) that arise

from owning the bond. Annual interest is 8% per year and the bonds will be redeemed at their nominal value of $100 per

bond in six years’ time. The before-tax cost of debt is given as 7% per year and this is used as a discount rate.

14Present value of future interest = (8 x 4767) = $3814

Present value of future principal payment = (100 x 0666) = $6660

Ex interest bond value = 3814 + 6660 = $10474 per bond

Market value of bonds = 120m x (10474/100) = $1257 million

After-tax cost of debt of 8% bonds

The before-tax cost of debt of the bonds is given as 7% per year.

After-tax cost of debt of bonds = 7 x (1 03) = 7 x 07 = 49% per year

Value of the 6% bank loan

The bank loan has no market value and so its book value of $40 million is used in calculating the weighted average cost of

capital.

After-tax cost of debt of 6% bank loan

The interest rate of the bank loan can be used as its before-tax cost of debt.

After-tax cost of debt of bank loan = 6 x (1 03) = 6 x 07 = 42% per year

Calculation of weighted average after-tax cost of capital (WACC)

Total value of company = 680m + 1257m + 40m = $8457m

After-tax WACC = ((680m x 10) + (1257m x 49) + (40 x 42))/8457 = 90 % per year

Examiner’s note: the after-tax cost of debt of the 8% bonds could have been calculated using linear interpolation, although

the result would be close to 49%.

(d) The weighted average cost of capital (WACC) is the average return required by current providers of finance. The WACC

therefore reflects the current risk of a company’s business operations (business risk) and way in which the company is

currently financed (financial risk). When the WACC is used as discount rate to appraise an investment project, an assumption

is being made that the project’s business risk and financial risk are the same as those currently faced by the investing

company. If this is not the case, a marginal cost of capital or a project-specific discount rate must be used to assess the

acceptability of an investment project.

The business risk of an investment project will be the same as current business operations if the project is an extension of

existing business operations, and if it is small in comparison with current business operations. If this is the case, existing

providers of finance will not change their current required rates of return. If these conditions are not met, a project-specific

discount rate should be calculated, for example by using the capital asset pricing model.

The financial risk of an investment project will be the same as the financial risk currently faced by a company if debt and

equity are raised in the same proportions as currently used, thus preserving the existing capital structure. If this is the case,

the current WACC can be used to appraise a new investment project. It may still be appropriate to use the current WACC as

a discount rate even when the incremental finance raised does not preserve the existing capital structure, providing that the

existing capital structure is preserved on an average basis over time via subsequent finance-raising decisions.

Where the capital structure is changed by finance raised for an investment project, it may be appropriate to use the marginal

cost of capital rather than the WACC.

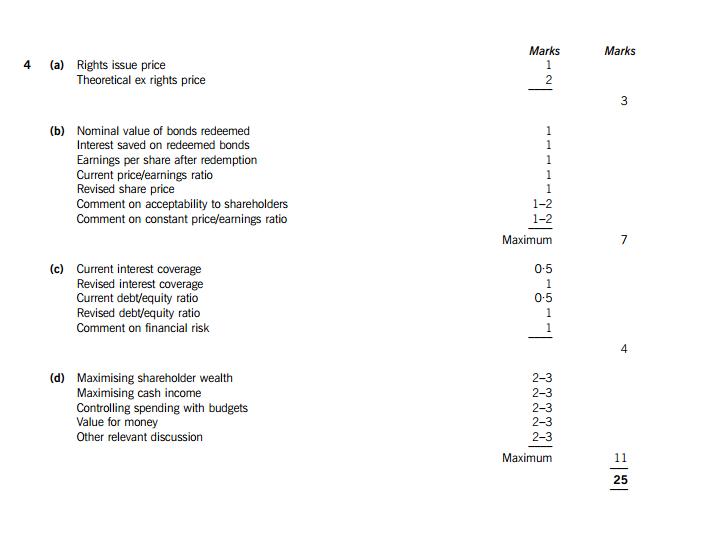

4 (a) Theoretical ex rights price

Rights issue price = 750 x 08 = $600 per share

Number of shares issued = $90m/600 = 15 million shares

Number of shares currently in issue = 60 million shares

The rights issue is on a 1 for 4 basis

Theoretical ex rights price = ((4 x 750) + (1 x 600))/5 = $720 per share

Alternatively, theoretical ex rights price = ((60m x 750) + (15m x 600))/75m = $720 per share, where 75 million is the

number of shares after the rights issue.

(b) Financial acceptability to shareholders of buying back bonds

The financial acceptability to shareholders of the proposal to buy back bonds can be assessed by calculating whether

shareholder wealth is increased or decreased as a result.

The bonds are being bought back by Bar Co at their market value of $11250 per bond, rather than their nominal value of

$100 per bond. The total nominal value of the bonds redeemed will therefore be less than the $90 million spent redeeming

them.

Nominal value of bonds redeemed = 90m x (100/11250) = $80 million

Interest saved by redeeming bonds = 80m x 008 = $64 million per year

Earnings per share will be affected by the redemption of the bonds and the issue of new shares.

Revised profit before tax = 49m (10m 64m) = $454 million

Revised profit after tax (earnings) = 454m x 07 = $3178 million

Revised earnings per share = 100 x (3178m/75m) = 4237 cents per share

15Current earnings per share = 100 x (27m/60m) = 45 cents per share

Current price/earnings ratio = 750/45 = 167 times

The revised earnings per share can be used to calculate a revised share price if the price/earnings ratio is assumed to be

constant.

Revised share price = 167 x 4237 = 708 cents or $708 per share

This share price is less than the theoretical ex rights price per share ($720) and so the effect of using the rights issue funds

to redeem the bonds is to decrease shareholder wealth. From a shareholder perspective, therefore, this use of the funds cannot

be recommended.

However, this conclusion depends heavily on the assumption that the price/earnings ratio remains constant, as this ratio was

used to calculate the revised share price from the revised earning per share. In reality, the share price after the redemption

of bonds will be set by the capital market and it is this market-determined share price that will determine the price/earnings

ratio, rather than the price/earnings ratio determining the share price. Since the financial risk of Bar Co has decreased

following the redemption of bonds, the cost of equity is likely to fall and the share price is likely to rise, leading to a higher

price/earnings ratio. If the share price increases to above the theoretical ex rights price per share, corresponding to an increase

in the price/earnings ratio to more than 17 times (720/4237), shareholders will experience a capital gain and so using the

cash raised by the rights issue to buy back bonds will become financially acceptable from their perspective.

(c) Current interest coverage ratio = 49m/10m = 49 times

Revised interest coverage ratio = 49m/(10m 64m) = 49m/36m = 136 times

Current debt/equity ratio = 100 x (125m/140m) = 89%

Revised book value of bonds = 125m 80m = $45 million

Revised book value of equity = 140m + 90m 10m = $220 million

A loss of $10 million is deducted here because $90 million has been spent to redeem bonds with a total nominal value (book

value) of $80 million.

Revised debt/equity ratio = 100 x (45m/220m) = 205%

Redeeming bonds with a book value of $80m has reduced the financial risk of Bar Co, as shown by the significant reduction

in gearing from 89% to 205%, and by the significant increase in the interest coverage ratio from 49 times to 136 times.

Examiner’s note: full credit would be given to a revised gearing calculation (196%) that omits the loss due to buying back

bonds at a premium to nominal value.

(d) A key financial objective for a stock exchange listed company is to maximise the wealth of shareholders. This objective is

usually replaced by the objective of maximising the company’s share price, since maximising the market value of the company

represents the maximum capital gain over a given period. The need for dividends can be met by recognising that share prices

can be seen as the sum of the present values of future dividends.

Maximising the company’s share price is the same as maximising the equity market value of the company, since equity market

value (market capitalisation) is equal to number of issued shares multiplied by share price. Maximising equity market value

can be achieved by maximising net corporate cash income and the expected growth in that income, while minimising the

corporate cost of capital. Listed companies therefore have maximising net cash income as a key financial objective.

Not-for-profit (NFP) organisations seek to provide services to the public and this requires cash income. Maximising net cash

income is therefore a key financial objective for NFP organisations as well as listed companies. A large charity seeks to raise

as much funds as possible in order to achieve its charitable objectives, which are non-financial in nature.

Both listed companies and NFP organisations need to control the use of cash within a given financial period, and both types

of organisations therefore use budgets. Another key financial objective for both organisations is therefore to keep spending

within budget.

The objective of value for money (VFM) is often identified in connection with NFP organisations. This objective refers to a

focus on economy, efficiency and effectiveness. These three terms can be linked to input (economy refers to securing

resources as economically as possible), process (resources need to be employed efficiently within the organisation) and output

(the effective use of resources in achieving the organisation’s objectives).

Described in these terms, it is clear that a listed company also seeks to achieve value for money in its business operations.

There is a difference in emphasis, however, which merits careful consideration. A listed company has a profit motive, and so

VFM for a listed company can be related to performance measures linked to output, e.g. maximising the equity market value

of the company. An NFP organisation has service-related outputs that are difficult to measure in quantitative terms and so it

focuses on performance measures linked to input, e.g. minimising the input cost for a given level of output.

Both listed companies and NFP organisations can use a variety of accounting ratios in the context of financial objectives. For

example, both types of organisation may use a target return on capital employed, or a target level of income per employee,

or a target current ratio.

Comparing and contrasting the financial objectives of a stock exchange listed company and a not-for-profit organisation,

therefore, shows that while significant differences can be found, there is a considerable amount of common ground in terms

of financial objectives.

相关推荐:

ACCA教材辅导讲义——Pilotpapers for F3

更多ACCA考试信息请关注读书人网(http://www.reader8.net/)

ACCA频道(http://www.reader8.net/exam/acca/)